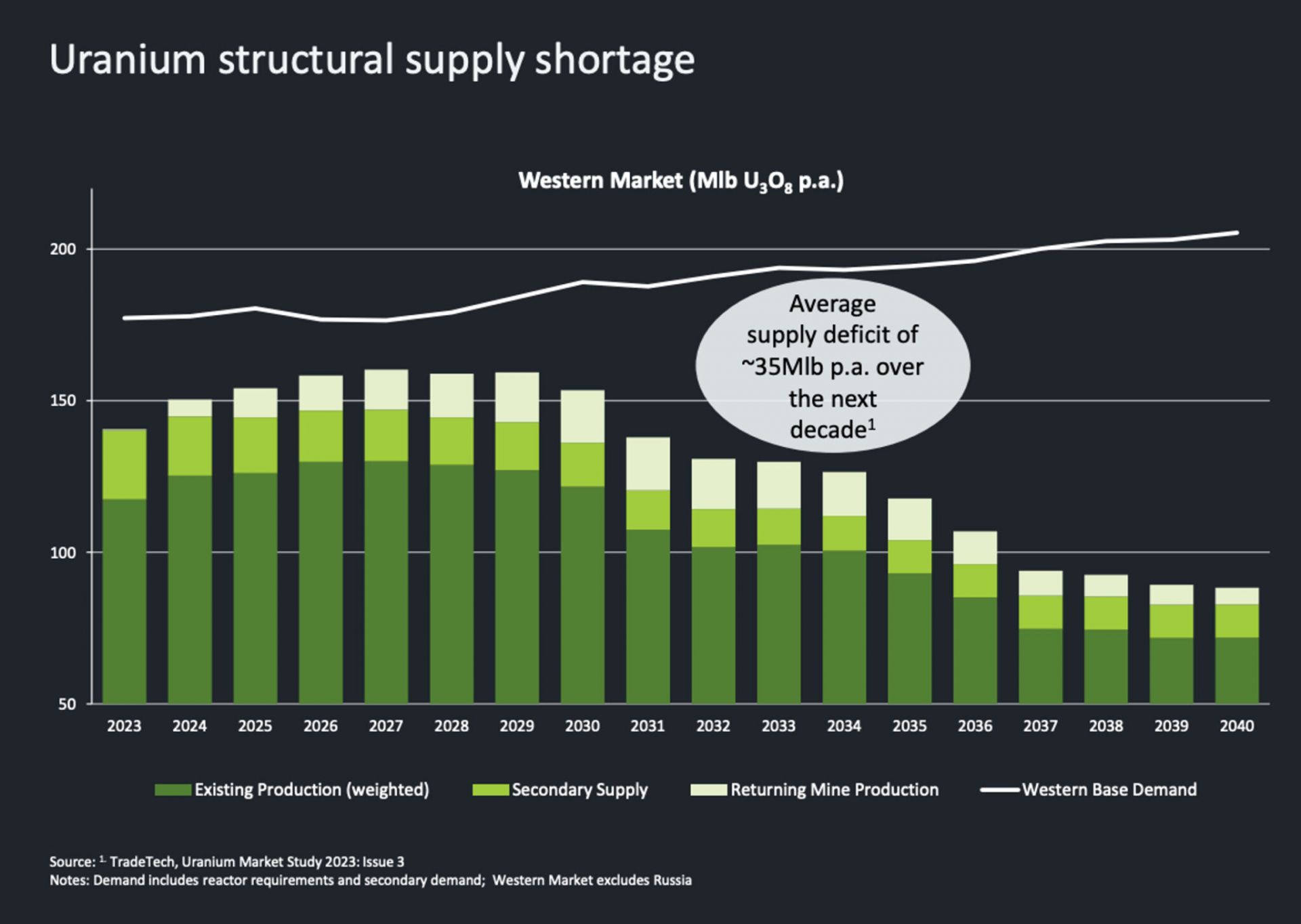

[Click to see full graphic] Western base demand (white line) for uranium will continue to outpace the combined existing production (dark green), secondary supply (middle green), and returning mine production (light green) through 2040, according to projections. (Image: Paladin Energy)

Investors continue to be bullish on uranium, according to a number of recent news reports. Stockhead recently trumpeted, “Uranium has started 2024 the same way it ended 2023—like a bull in a china shop. Spot prices are now agonizingly close to US$100/lb for the first time since 2008, with term pricing not far behind.” Similarly, Mining.com noted, “The spot price of uranium continues to rise, boosted by pledges to triple nuclear power by mid-century, supply hiccups from producers such as Cameco . . . , and the looming threat of a ban on Russian exports to the West.”

The Irigaray central processing plant, in Wyoming’s Powder River Basin. (Photo: Uranium Energy)

TerraPower and Uranium Energy announced today that they have signed a memorandum of understanding to “explore the potential supply of uranium” for TerraPower’s demonstration reactor in Kemmerer, Wyo.

A bank of Urenco centrifuges. (Photo: Urenco USA)

Urenco announced July 6 that it will expand enrichment capacity at its U.S. site in Eunice, N.M.—known as UUSA—by adding new centrifuge cascades to increase capacity by about 700 metric tons of separative work units per year, or a 15 percent increase, with the first new cascades coming on line in 2025.

Pictured, from left, are Steve Nesbit, Christina Leggett, John Kessler, Paul Dickman, John Mattingly, and Craig Hansen. Edwin Lyman, who joined the panel remotely, is not pictured.

Advanced reactors may be key to a clean energy future, but to prove it they’re going to need fuel—and that fuel will be derived from limited uranium resources and managed throughout the nuclear fuel cycle, whether that cycle is open (like the current fuel cycle) or closed (with reprocessing). Six panelists convened on June 12 during the Annual Meeting of the American Nuclear Society for the executive session “Merits and Viability of Advanced Nuclear Fuel Cycles: A Discussion with the National Academies.” They discussed those fuel cycles and the findings of a National Academies of Science, Engineering, and Medicine (NASEM) consensus committee released as a draft report in November 2022 and published earlier this year.

Centrus’s HALEU demonstration cascade. (Photo: Centrus Energy)

Centrus Energy announced yesterday that it has received Nuclear Regulatory Commission approval to introduce uranium hexafluoride into its 16-machine centrifuge cascade in Piketon, Ohio, following operational readiness reviews by the NRC. Centrus says it “remains on track to begin production of high-assay low-enriched uranium (HALEU) by the end of 2023.” The announcement follows a series of inspections at the American Centrifuge site in April 2023.

The ministers representing their respective nations as the statement on civil nuclear fuel cooperation was announced were (from left) Jonathan Wilkinson, minister of natural resources of Canada; Yasutoshi Nishimura, Japan’s minister of economy, trade, and industry; Jennifer Granholm, U.S. energy secretary; Grant Shapps, U.K. energy security secretary; and Agnes Pannier-Runacher, French minister for energy transition.

A civil nuclear fuel security agreement between the five nuclear leaders of the G7—announced on April 16 on the sidelines of the G7 Ministers’ Meeting on Climate, Energy and Environment in Sapporo, Japan—establishes cooperation between Canada, France, Japan, the United Kingdom, and the United States to flatten Russia’s influence in the global nuclear fuel supply chain.

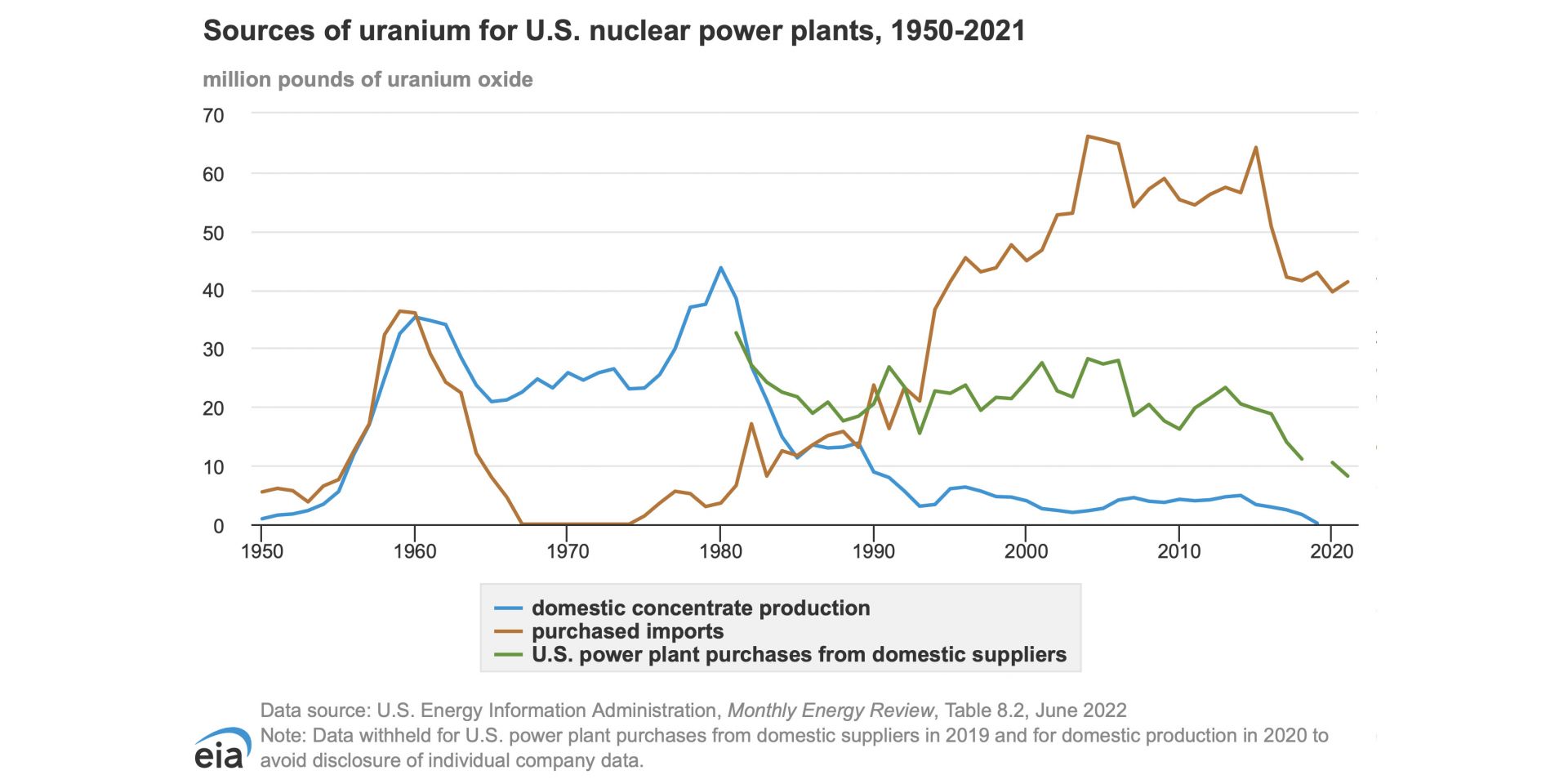

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

Energy Fuels’ White Mesa Mill in southeastern Utah is the only operating conventional uranium mill in the United States. (Photo: Energy Fuels)

The bipartisan Nuclear Fuel Security Act (NFSA), introduced in the Senate last week, would authorize the Department of Energy to establish a Nuclear Fuel Security Program to “ensure a disruption in Russian uranium supply would not impact the development of advanced reactors or the operation of the United States’ light water reactor fleet.” The bill was introduced by Sen. Joe Manchin (D., W.V.), chairman of the Senate Energy and Natural Resources (ENR) Committee; Sen. John Barrasso (R., Wyo.), ranking member of the Senate ENR committee; and Sen. Jim Risch (R., Idaho).