An illustration of an IMSR plant. (Image: Terrestrial Energy)

Ontario–based Terrestrial Energy announced yesterday that its U.S. branch has been awarded a regulatory assistance grant from the Department of Energy to support the company’s Nuclear Regulatory Commission licensing program for the Integral Molten Salt Reactor (IMSR) plant.

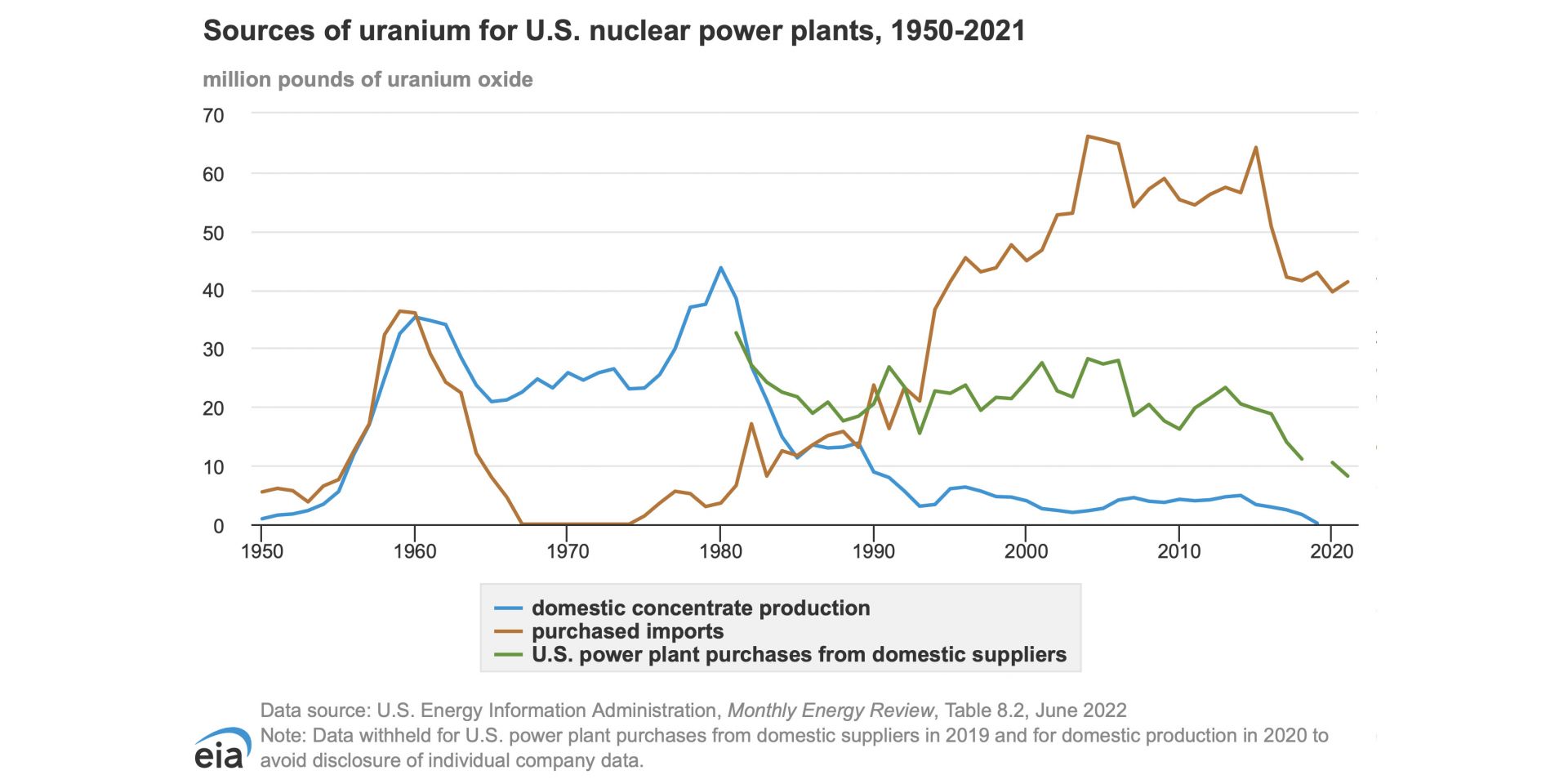

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

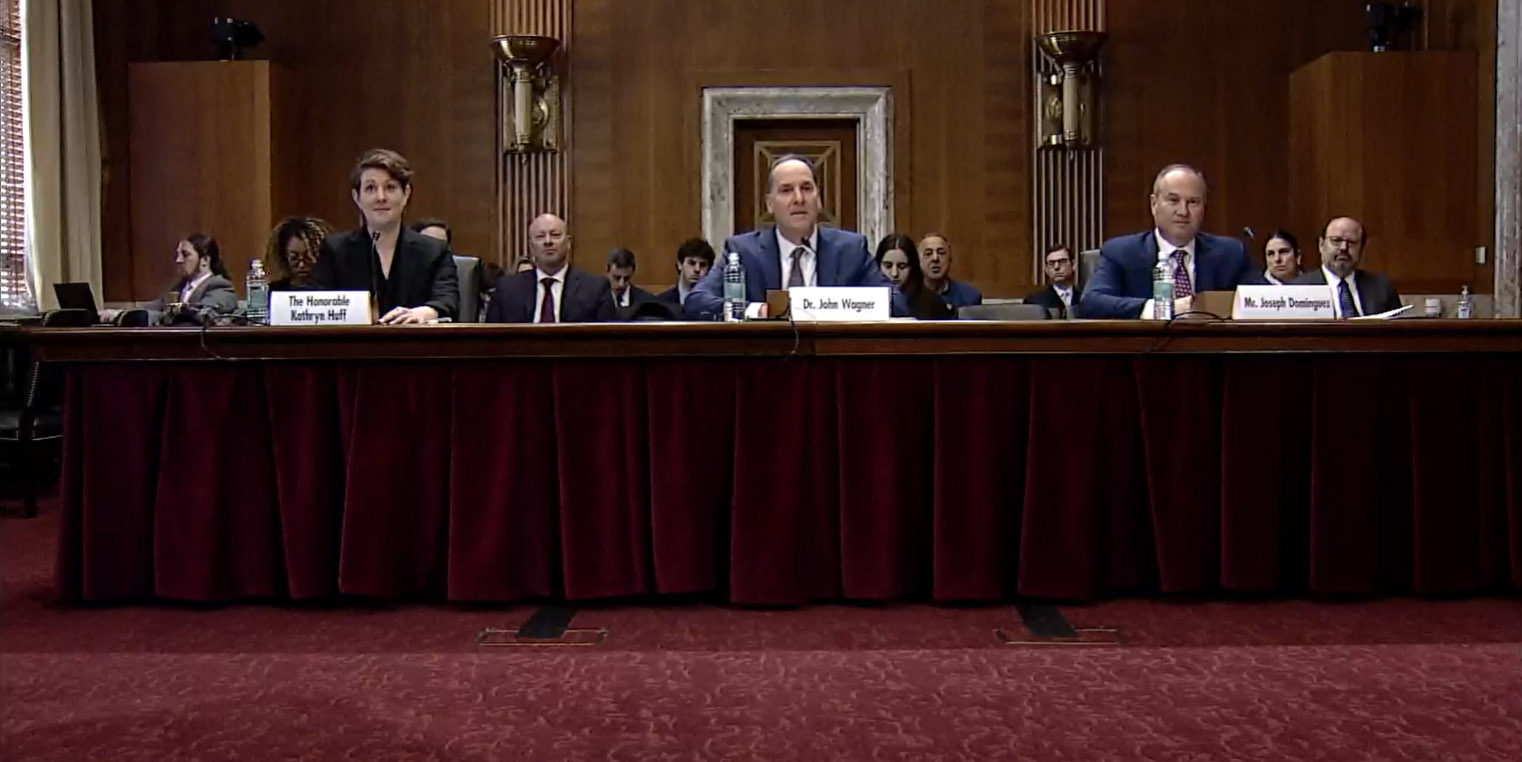

March 14, 2023, 9:39AMEdited March 14, 2023, 9:38AMNuclear News In this screenshot from a video recording of the hearing, Huff, Wagner, and Dominguez answer a series of questions from Sen. Manchin

“Right now, our country is deficient in nearly every aspect of the fuel cycle. This must change and it must change quickly,” said Sen. Joe Manchin (D., W.V.), chairman of the Senate Committee on Energy and Natural Resources (ENR), as he opened a Full Committee Hearing to Examine the Nuclear Fuel Cycle on March 9. “Whether it is uranium mining, milling, conversion, enrichment, nuclear fuel fabrication, power generation, or nuclear waste storage and disposal, there is much work to be done, starting with conversion and enrichment. Simply put, Russia dominates the global market, representing nearly half of the international capacity for both processes.”

Energy Fuels’ White Mesa Mill in southeastern Utah is the only operating conventional uranium mill in the United States. (Photo: Energy Fuels)

The bipartisan Nuclear Fuel Security Act (NFSA), introduced in the Senate last week, would authorize the Department of Energy to establish a Nuclear Fuel Security Program to “ensure a disruption in Russian uranium supply would not impact the development of advanced reactors or the operation of the United States’ light water reactor fleet.” The bill was introduced by Sen. Joe Manchin (D., W.V.), chairman of the Senate Energy and Natural Resources (ENR) Committee; Sen. John Barrasso (R., Wyo.), ranking member of the Senate ENR committee; and Sen. Jim Risch (R., Idaho).

A view of the completed demo cascade. (Photo: Centrus)

Centrus Energy announced February 9 that it has finished assembling a cascade of uranium enrichment centrifuges and most of the associated support systems ahead of its contracted demonstration of high-assay low-enriched uranium (HALEU) production by the end of 2023. When the 16-machine cascade begins operating inside the Piketon, Ohio, American Centrifuge Plant, which has room for 11,520 machines, it will be the first new U.S.-technology based enrichment plant to begin production in 70 years.

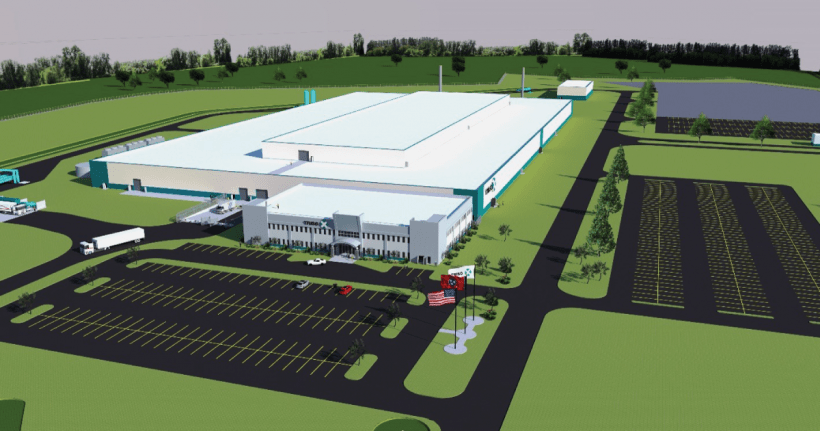

A rendering of the TRISO-X fuel fabrication facility. (Image: DOE)

The Nuclear Regulatory Commission recently presented its proposed 30-month licensing review timeline of TRISO-X’s planned fuel fabrication facility at the project’s first-ever public meeting in Oak Ridge, Tenn.

TRISO-X, a subsidiary of X-energy, has requested a 40-year license to possess and use special nuclear material to manufacture advanced fuel. The facility would be the first-ever commercial-scale fuel fabrication plant focused on using high-assay low-enriched uranium (HALEU).

Artist’s concept of the DRACO spacecraft, which will demonstrate a nuclear thermal rocket engine. (Image: DARPA)

NASA and the Defense Advanced Research Projects Agency (DARPA) have announced they will collaborate on plans to launch and test DARPA’s Demonstration Rocket for Agile Cislunar Operations (DRACO). DARPA has already worked with private companies on the baseline design for a fission reactor and rocket engine—and the spacecraft that will serve as an in-orbit test stand—and has solicited proposals for the next phase of work. Now NASA is climbing on board, deepening its existing ties to DRACO’s work in nuclear thermal propulsion (NTP) technology—an “enabling capability” required for NASA to meet its Moon to Mars Objectives and send crewed missions to Mars. NASA and DARPA representatives announced the development at the American Institute of Aeronautics and Astronautics SciTech Forum in National Harbor, Md., on January 24.

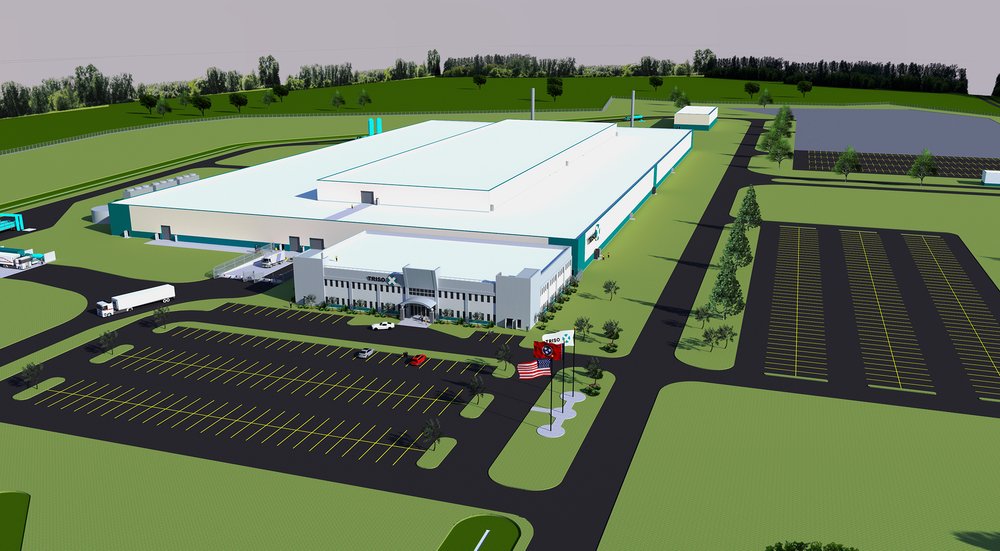

Artist’s rendering of the proposed TRISO-X World Headquarters and Commercial Fuel Facility at the Horizon Center Industrial Park in Oak Ridge, Tenn. (Image: X-energy)

The Nuclear Regulatory Commission has accepted an application from X-energy's fuel subsidiary, TRISO-X LLC, for a proposed TRISO-X Fuel Fabrication Facility (TF3) in Oak Ridge, Tenn., X-energy announced last week. A 30-month review schedule has been developed by the NRC that would be completed by June 2025, assuming TRISO-X provides sufficient responses to expected requests for additional information (RAIs) within 30 to 60 days of their issuance. On December 16, the NRC announced that it would seek public input on the scope of its environmental review and environmental impact statement for the application and published a notice in the Federal Register.

These gas centrifuges operated in the Piketon facility from 2013 to 2016 as part of a 120-machine low-enriched uranium demonstration cascade. (Photo: Centrus Energy)

Centrus Energy confirmed on December 1 that its wholly owned subsidiary American Centrifuge Operating signed a contract with the Department of Energy, which was first announced on November 10, to complete and operate a demo-scale high-assay low-enriched uranium (HALEU) gaseous centrifuge cascade.

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

Centrifuge casings arrive in Piketon, Ohio. (Photo: Centrus Energy)

The Department of Energy announced a cost-shared award on November 10 valued at about $150 million for American Centrifuge Operating, a subsidiary of Centrus Energy, to complete the high-assay low-enriched uranium (HALEU) demonstration project it began in 2019. After delays that Centrus attributes in part to the COVID-19 pandemic, the company now has until the end of 2023 to produce the first 20 kilograms of HALEU enriched to 19.75 percent U-235 from the 16-centrifuge cascade it has installed in a DOE-owned Piketon, Ohio, facility—the only U.S. facility currently licensed to produce HALEU.