These gas centrifuges operated in the Piketon facility from 2013 to 2016 as part of a 120-machine low-enriched uranium demonstration cascade. (Photo: Centrus Energy)

Centrus Energy confirmed on December 1 that its wholly owned subsidiary American Centrifuge Operating signed a contract with the Department of Energy, which was first announced on November 10, to complete and operate a demo-scale high-assay low-enriched uranium (HALEU) gaseous centrifuge cascade.

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

Centrifuge casings arrive in Piketon, Ohio. (Photo: Centrus Energy)

The Department of Energy announced a cost-shared award on November 10 valued at about $150 million for American Centrifuge Operating, a subsidiary of Centrus Energy, to complete the high-assay low-enriched uranium (HALEU) demonstration project it began in 2019. After delays that Centrus attributes in part to the COVID-19 pandemic, the company now has until the end of 2023 to produce the first 20 kilograms of HALEU enriched to 19.75 percent U-235 from the 16-centrifuge cascade it has installed in a DOE-owned Piketon, Ohio, facility—the only U.S. facility currently licensed to produce HALEU.

Participating in the forum were (from left) John Hopkins (NuScale Power), Renaud Crassous (EDF), Daniel Poneman (Centrus Energy), Adriana Cristina Serquis (CNEA), and Boris Schucht (Urenco).

The nuclear industry leaders assembled in Washington, D.C., last week to discuss small modular reactor supply chains agreed that lost generation capacity from the expected retirement of hundreds or thousands of coal power plants over the next decade—a cliff, in one panelist’s words—represents an opportunity that developers of SMRs and advanced reactors are competing to meet.

“I think in total 80 projects are ongoing,” said Boris Schucht, panel moderator and chief executive officer of Urenco Group, as he opened the forum. “Of course not all of them will win, and we will discuss today what is needed so that they can be successful.”

Natrium Fuel Facility groundbreaking. (Photo: GNF-A)

Global Nuclear Fuel–Americas (GNF-A) and TerraPower announced their plans to build a Natrium fuel fabrication facility next to GNF-A’s existing fuel plant near Wilmington, N.C, on October 21. While more than 50 years of fuel fabrication at the site have supported the boiling water reactor designs of GE (GNF-A’s majority owner) and GE Hitachi Nuclear Energy (GEH), the Natrium Fuel Facility will produce metallic high-assay low-enriched uranium (HALEU) fuel for the sodium fast reactor—Natrium—that TerraPower is developing with GEH.

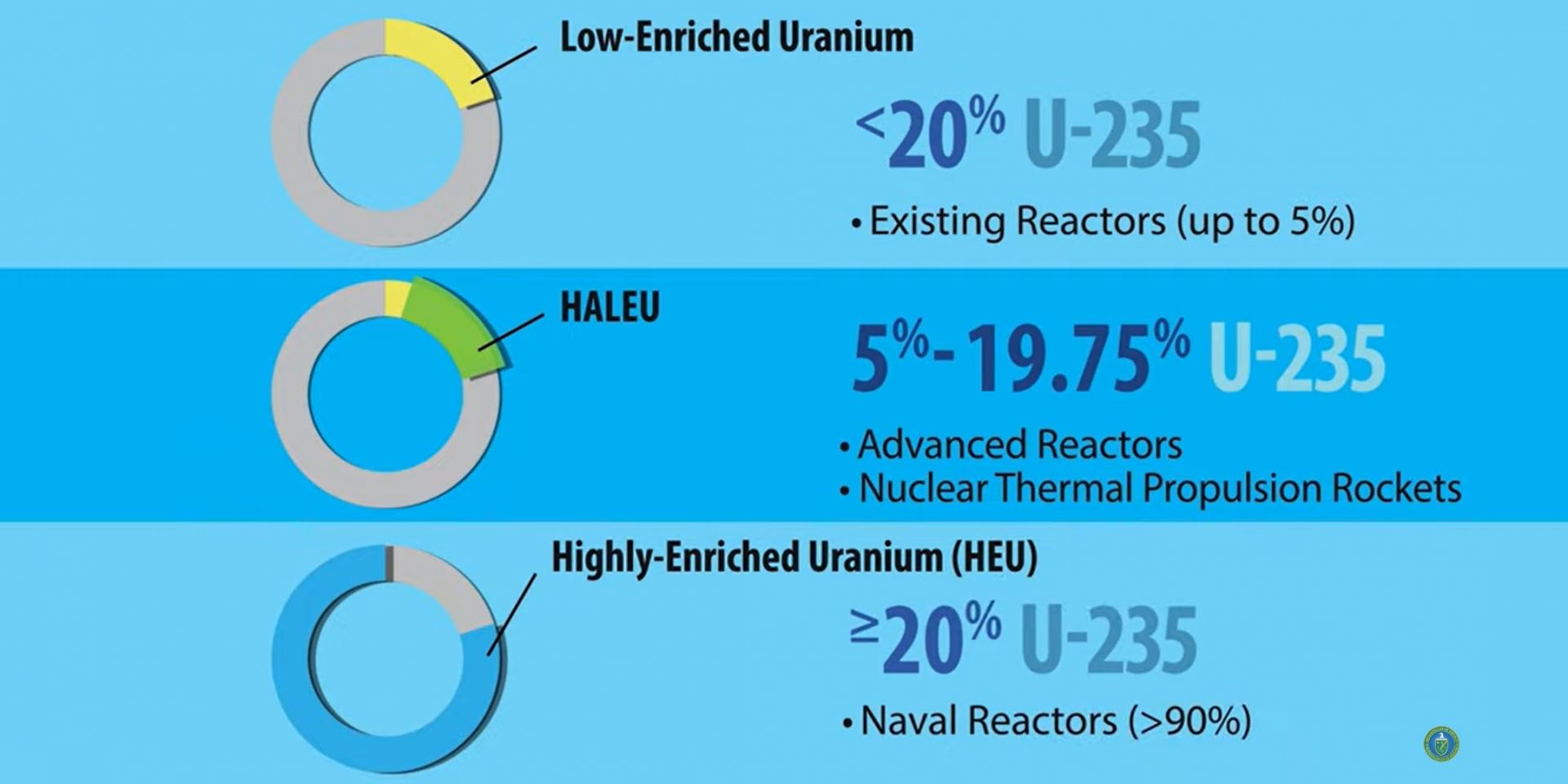

An image from the video “What is High-Assay Low-Enriched Uranium (HALEU)?” released by the DOE in April 2020. (Source: DOE)

Another piece of the plan for meeting the urgent need for high-assay low-enriched uranium (HALEU) to fuel advanced reactor deployments fell into place when the Department of Energy held an Industry Day on October 14. Attendees were asked how soon they could deliver 25 metric tons per year of HALEU enriched in the United States from newly mined uranium. Offtake contracts for six or more years of HALEU production at that rate could be used to stock a DOE-owned HALEU bank to “support [HALEU] availability for civilian domestic research, development, demonstration, and commercial use.”

HALEU in the form of 1.5–3 kg reguli ready for fuel fabrication. (Photo: INL)

Those who welcomed the $700 million earmarked for high-assay low-enriched uranium (HALEU) supply in the Inflation Reduction Act of 2022 (IRA) in August have cause to celebrate again. The White House sent a supplemental appropriation request to Congress on September 2 that would provide more than double the IRA funds if passed—$1.5 billion—for the Department of Energy’s Office of Nuclear Energy to build a reliable supply of both low-enriched uranium for existing U.S. nuclear power plants and HALEU for the advanced reactors that will be built within the decade.

Energy Northwest’s Columbia Generating Station, in Richland, Wash. (Photo: Energy Northwest)

Energy Northwest, owner and operator of Columbia Generating Station in Richland, Wash., recently signed a memorandum of understanding with nuclear technology firm Curio Solutions regarding Curio’s NuCycle nuclear waste recycling process.

Columbia is the Northwest’s only operating nuclear power plant, consisting of one 1,207-MWe boiling water reactor. There are currently 54 concrete and steel casks on site, holding the spent fuel produced by the reactor since it began commercial operation in 1984.

A rendering of the MCRE. (Image: Southern Company)

The Gateway for Accelerated Innovation in Nuclear (GAIN) awarded vouchers to Orano Federal Services and TerraPower on June 22, giving them access to specialized facilities and expertise at Department of Energy national laboratories. Orano is partnering with Oak Ridge National Laboratory on a new technical study that updates the physical chemistry limits for the safe transport of uranium hexafluoride (UF6) gas enriched up to 10 percent in existing shipping containers, and TerraPower is turning to Los Alamos National Laboratory’s neutron testing capabilities to measure the properties of chlorine isotopes and determine how they will behave in the Molten Chloride Reactor Experiment (MCRE).