These graphs illustrate how rapidly scaling the nuclear industrial base would enable nearer-term decarbonization and increase capital efficiency, versus a five-year delay to reach the same 200 GW deployment by 2050. (Source: DOE, Pathways to Commercial Liftoff: Advanced Nuclear, Fig. 1)

The Department of Energy released Pathways to Commercial Liftoff: Advanced Nuclear earlier this month. It is one of the first in a series of reports on clean energy technologies and the private and public investments needed to overcome hurdles to full-scale deployment. The report makes a clear case for investment in nuclear power and challenges potential investors and operators to move beyond the current “wait and see” stalemate and generate “a committed orderbook . . . for 5–10 deployments of at least one reactor design by 2025.”

Energy Fuels’ White Mesa Mill in southeastern Utah is the only operating conventional uranium mill in the United States. (Photo: Energy Fuels)

The bipartisan Nuclear Fuel Security Act (NFSA), introduced in the Senate last week, would authorize the Department of Energy to establish a Nuclear Fuel Security Program to “ensure a disruption in Russian uranium supply would not impact the development of advanced reactors or the operation of the United States’ light water reactor fleet.” The bill was introduced by Sen. Joe Manchin (D., W.V.), chairman of the Senate Energy and Natural Resources (ENR) Committee; Sen. John Barrasso (R., Wyo.), ranking member of the Senate ENR committee; and Sen. Jim Risch (R., Idaho).

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

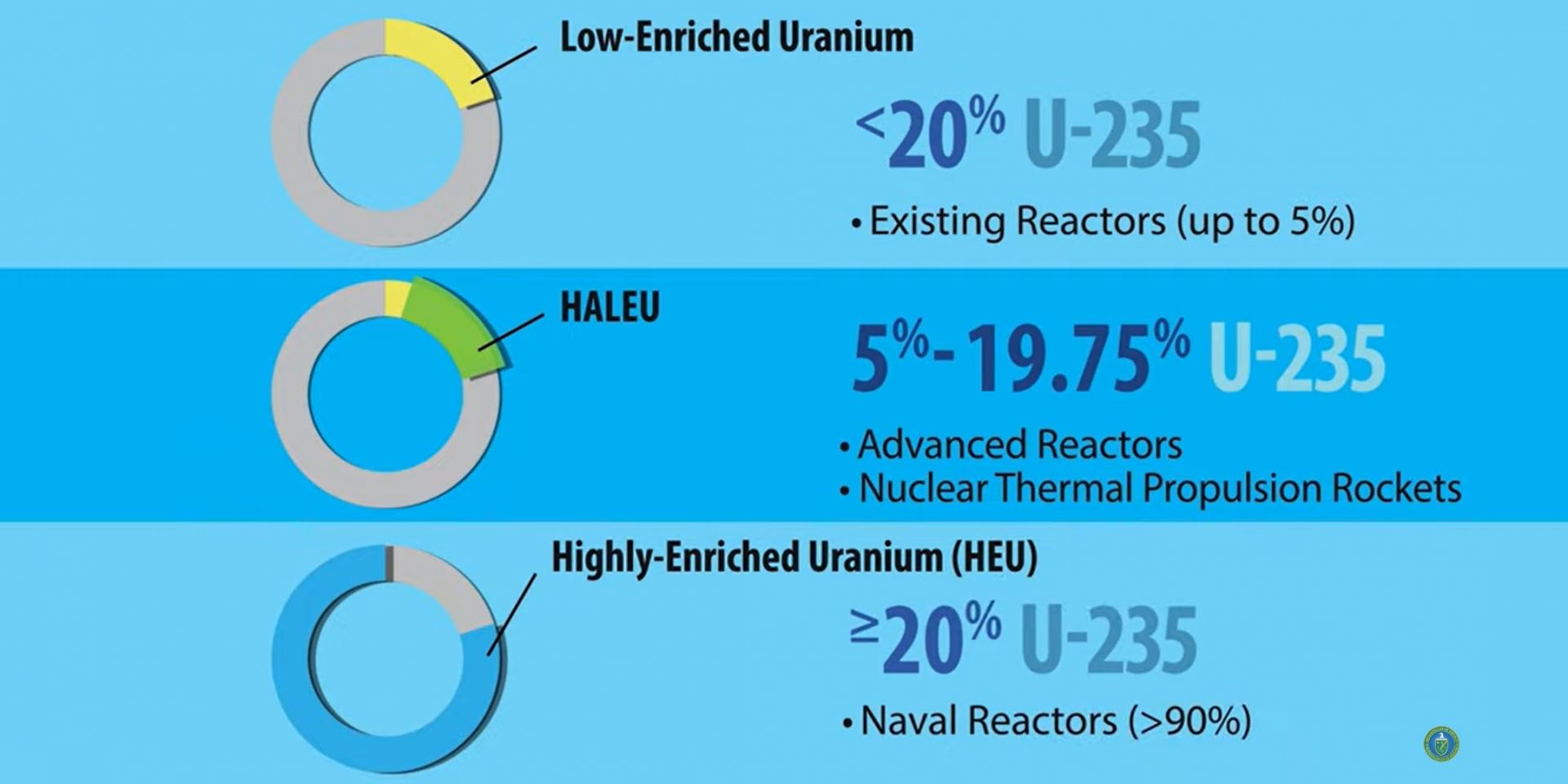

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

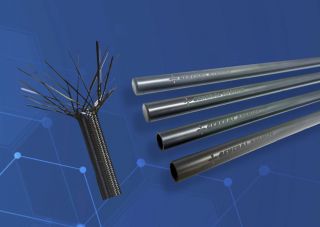

Centrifuge casings arrive in Piketon, Ohio. (Photo: Centrus Energy)

The Department of Energy announced a cost-shared award on November 10 valued at about $150 million for American Centrifuge Operating, a subsidiary of Centrus Energy, to complete the high-assay low-enriched uranium (HALEU) demonstration project it began in 2019. After delays that Centrus attributes in part to the COVID-19 pandemic, the company now has until the end of 2023 to produce the first 20 kilograms of HALEU enriched to 19.75 percent U-235 from the 16-centrifuge cascade it has installed in a DOE-owned Piketon, Ohio, facility—the only U.S. facility currently licensed to produce HALEU.

INL’s Materials and Fuels Complex. (Photo: INL)

The Department of Energy announced $150 million in Inflation Reduction Act funding on October 25 for infrastructure improvements at Idaho National Laboratory. According to the DOE, the funding will support nearly a dozen projects at INL’s Advanced Test Reactor (ATR) and Materials Fuels Complex (MFC), both of which have operated for more than 50 years. The investments in existing infrastructure assets mean support for nuclear energy research and development, including fuel testing, bolstering the near-term supply of high-assay low-enriched uranium (HALEU), and reactor demonstrations.

An image from the video “What is High-Assay Low-Enriched Uranium (HALEU)?” released by the DOE in April 2020. (Source: DOE)

Another piece of the plan for meeting the urgent need for high-assay low-enriched uranium (HALEU) to fuel advanced reactor deployments fell into place when the Department of Energy held an Industry Day on October 14. Attendees were asked how soon they could deliver 25 metric tons per year of HALEU enriched in the United States from newly mined uranium. Offtake contracts for six or more years of HALEU production at that rate could be used to stock a DOE-owned HALEU bank to “support [HALEU] availability for civilian domestic research, development, demonstration, and commercial use.”

The Integrated Effects Test at TerraPower’s laboratory in Everett, Wash. (Photo: Southern Company/TerraPower)

“The world's largest chloride salt system developed by the nuclear sector” is now ready for operation in TerraPower’s Everett, Wash., laboratories. Southern Company, which is working with TerraPower through its subsidiary Southern Company Services to develop molten chloride reactor technology, announced on October 18 that the Integrated Effects Test (IET) was complete. The multiloop, nonnuclear test infrastructure follows years of separate effects testing using isolated test loops, and it was built to support the operation of the Molten Chloride Reactor Experiment (MCRE) at Idaho National Laboratory that the companies expect will, in turn, support a demonstration-scale Molten Chloride Fast Reactor (MCFR).

An aerial view of ORNL’s main campus. (Photo: ORNL)

The Gateway for Accelerated Innovation in Nuclear (GAIN) announced the three recipients of its fourth and final round of 2022 vouchers on October 10. The vouchers were awarded to Curio Solutions, which is developing a spent fuel recycling process, and to two companies that are separately investigating advanced reactor siting—Elementl Power and the Tennessee Valley Authority (TVA). The funds for each award will go directly to Oak Ridge National Laboratory.