Centrus employees maneuver a cylinder at the American Centrifuge Plant in Piketon, Ohio. (Photo: Centrus Energy)

Centrus Energy announced a plan yesterday to add 300 new jobs at Centrus’s uranium enrichment plant in Piketon, Ohio, “in advance of federal funding decisions.” The company envisions adding capacity for both low-enriched uranium and high-assay low-enriched uranium production at its American Centrifuge Plant, but the “size and scope” of public and private investment is “subject to being selected for funding by the U.S. Department of Energy.”

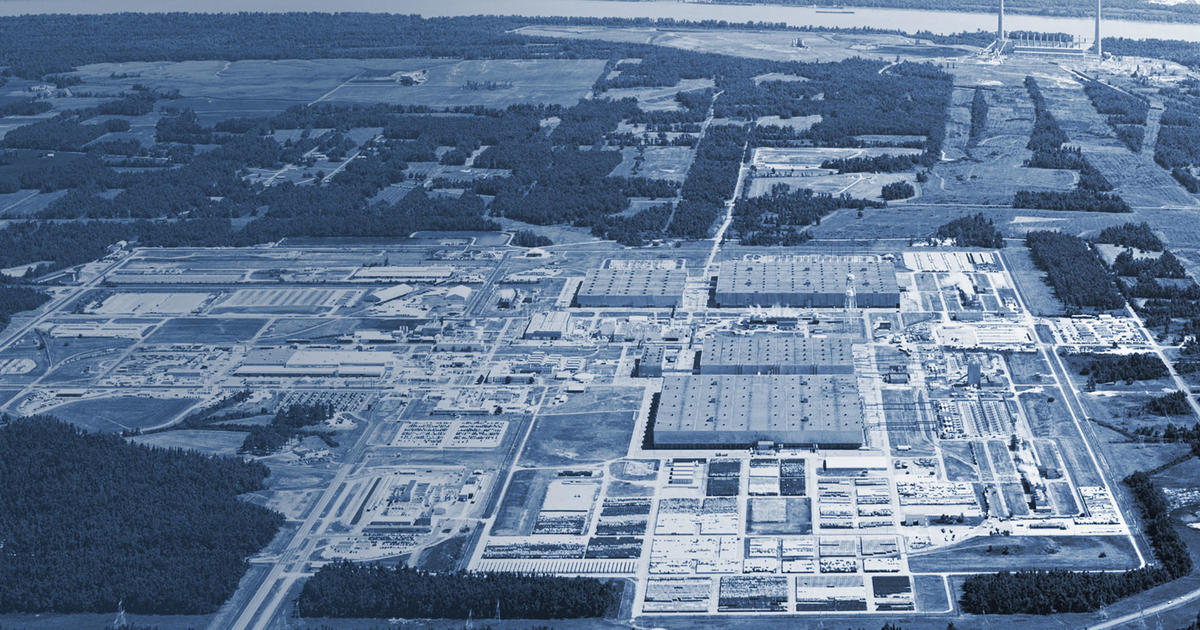

GLE’s PLEF would be sited next to the DOE’s Paducah plant, which stopped operating in 2013. (Photo: DOE)

As part of its environmental review of Global Laser Enrichment’s planned Paducah Laser Enrichment Facility (PLEF) in Kentucky, the Nuclear Regulatory Commission announced it will conduct a scoping process ahead of preparing an environmental impact statement for GLE’s license application. Announced in the September 5 Federal Register, the NRC is seeking written comments on the scope of the EIS until October 6.

Uranium hexafluoride gas containers. (Photo: DOE)

The Department of Energy announced yesterday the six companies that it has selected to supply low-enriched uranium (LEU) from new domestic enrichment sources under future contracts for up to 10 years. The contract recipients are: Centrus Energy’s American Centrifuge Operating, General Matter, Global Laser Enrichment (GLE), Laser Isotope Separation Technologies (LIS Technologies), Orano Federal Services, and Urenco USA’s Louisiana Energy Services.

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

(Click photo to enlarge) One of 16 AC100M gas centrifuges built by Centrus Energy for HALEU production in Piketon, Ohio. (Photo: Centrus Energy)

For years, pressure has been building for a commercial path to a stable supply of high-assay low-enriched uranium (HALEU)—deemed essential for the deployment of advanced power reactors—but advanced reactor developers and enrichment companies are still watching and waiting. In contrast, the uranium spot price soared after Sprott Physical Uranium Trust, a Canadian investment fund formed in July, began buying up U3O8 supplies, causing the price to increase over 60 percent, topping $50 per pound for the first time since 2012. Fueled by growing acknowledgment that nuclear power is a necessary part of a clean energy future, uranium is the focus of attention from Wall Street to Capitol Hill.

-3 2x1.jpg)