View of the machine controls electronics of Centrus’s HALEU demonstration cascade. (Photo: Centrus)

TerraPower and Centrus Energy Corp. announced on July 17 that they have signed a memorandum of understanding to “significantly expand their collaboration aimed at establishing commercial-scale, domestic production capabilities for high-assay, low-enriched uranium (HALEU)” to supply fuel for TerraPower’s first Natrium reactor. Nearly three years ago, TerraPower first announced plans to work with Centrus to establish commercial-scale HALEU production facilities. The two companies signed a contract in 2021 for services to help expedite the commercialization of enrichment technology at Centrus’s Piketon, Ohio, facility.

A bank of Urenco centrifuges. (Photo: Urenco USA)

Urenco announced July 6 that it will expand enrichment capacity at its U.S. site in Eunice, N.M.—known as UUSA—by adding new centrifuge cascades to increase capacity by about 700 metric tons of separative work units per year, or a 15 percent increase, with the first new cascades coming on line in 2025.

Centrus’s HALEU demonstration cascade. (Photo: Centrus Energy)

Centrus Energy announced yesterday that it has received Nuclear Regulatory Commission approval to introduce uranium hexafluoride into its 16-machine centrifuge cascade in Piketon, Ohio, following operational readiness reviews by the NRC. Centrus says it “remains on track to begin production of high-assay low-enriched uranium (HALEU) by the end of 2023.” The announcement follows a series of inspections at the American Centrifuge site in April 2023.

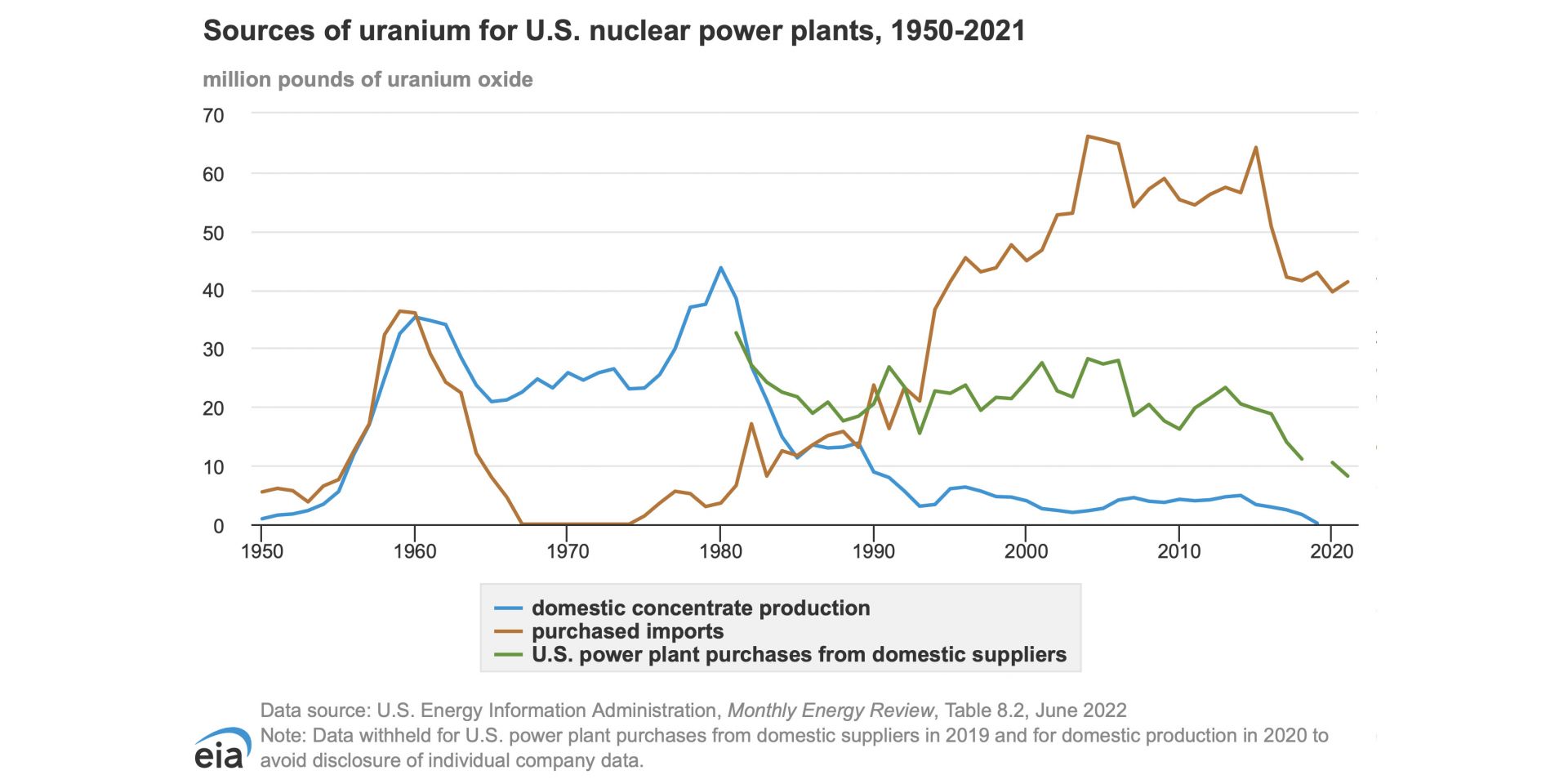

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

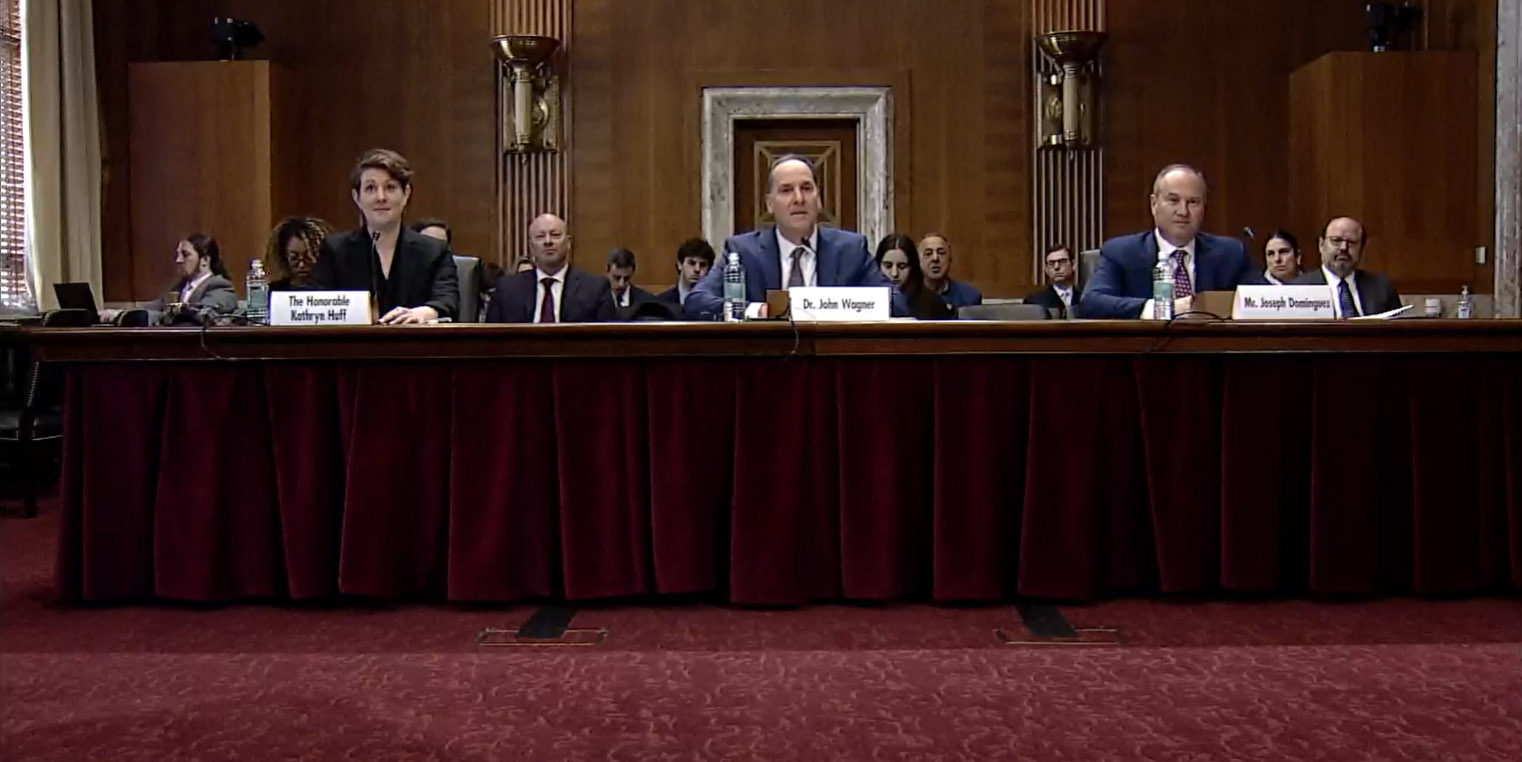

March 14, 2023, 9:39AMEdited March 14, 2023, 9:38AMNuclear News In this screenshot from a video recording of the hearing, Huff, Wagner, and Dominguez answer a series of questions from Sen. Manchin

“Right now, our country is deficient in nearly every aspect of the fuel cycle. This must change and it must change quickly,” said Sen. Joe Manchin (D., W.V.), chairman of the Senate Committee on Energy and Natural Resources (ENR), as he opened a Full Committee Hearing to Examine the Nuclear Fuel Cycle on March 9. “Whether it is uranium mining, milling, conversion, enrichment, nuclear fuel fabrication, power generation, or nuclear waste storage and disposal, there is much work to be done, starting with conversion and enrichment. Simply put, Russia dominates the global market, representing nearly half of the international capacity for both processes.”

Energy Fuels’ White Mesa Mill in southeastern Utah is the only operating conventional uranium mill in the United States. (Photo: Energy Fuels)

The bipartisan Nuclear Fuel Security Act (NFSA), introduced in the Senate last week, would authorize the Department of Energy to establish a Nuclear Fuel Security Program to “ensure a disruption in Russian uranium supply would not impact the development of advanced reactors or the operation of the United States’ light water reactor fleet.” The bill was introduced by Sen. Joe Manchin (D., W.V.), chairman of the Senate Energy and Natural Resources (ENR) Committee; Sen. John Barrasso (R., Wyo.), ranking member of the Senate ENR committee; and Sen. Jim Risch (R., Idaho).

A view of the completed demo cascade. (Photo: Centrus)

Centrus Energy announced February 9 that it has finished assembling a cascade of uranium enrichment centrifuges and most of the associated support systems ahead of its contracted demonstration of high-assay low-enriched uranium (HALEU) production by the end of 2023. When the 16-machine cascade begins operating inside the Piketon, Ohio, American Centrifuge Plant, which has room for 11,520 machines, it will be the first new U.S.-technology based enrichment plant to begin production in 70 years.

These gas centrifuges operated in the Piketon facility from 2013 to 2016 as part of a 120-machine low-enriched uranium demonstration cascade. (Photo: Centrus Energy)

Centrus Energy confirmed on December 1 that its wholly owned subsidiary American Centrifuge Operating signed a contract with the Department of Energy, which was first announced on November 10, to complete and operate a demo-scale high-assay low-enriched uranium (HALEU) gaseous centrifuge cascade.

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

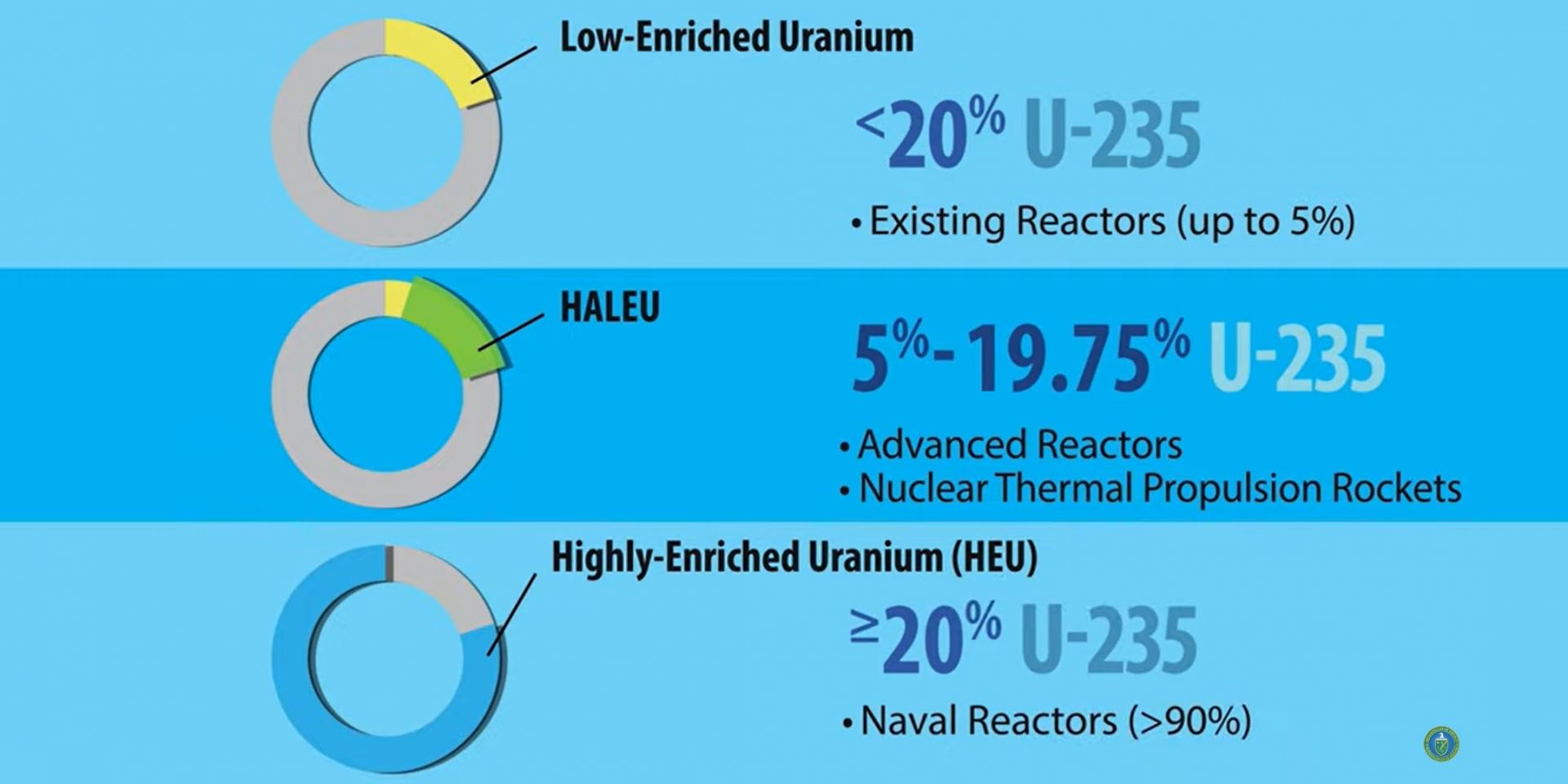

An image from the video “What is High-Assay Low-Enriched Uranium (HALEU)?” released by the DOE in April 2020. (Source: DOE)

Another piece of the plan for meeting the urgent need for high-assay low-enriched uranium (HALEU) to fuel advanced reactor deployments fell into place when the Department of Energy held an Industry Day on October 14. Attendees were asked how soon they could deliver 25 metric tons per year of HALEU enriched in the United States from newly mined uranium. Offtake contracts for six or more years of HALEU production at that rate could be used to stock a DOE-owned HALEU bank to “support [HALEU] availability for civilian domestic research, development, demonstration, and commercial use.”

HALEU in the form of 1.5–3 kg reguli ready for fuel fabrication. (Photo: INL)

Those who welcomed the $700 million earmarked for high-assay low-enriched uranium (HALEU) supply in the Inflation Reduction Act of 2022 (IRA) in August have cause to celebrate again. The White House sent a supplemental appropriation request to Congress on September 2 that would provide more than double the IRA funds if passed—$1.5 billion—for the Department of Energy’s Office of Nuclear Energy to build a reliable supply of both low-enriched uranium for existing U.S. nuclear power plants and HALEU for the advanced reactors that will be built within the decade.

Artist’s conception of Oklo’s Aurora powerhouse. (Image: Gensler)

(Click photo to enlarge) One of 16 AC100M gas centrifuges built by Centrus Energy for HALEU production in Piketon, Ohio. (Photo: Centrus Energy)

For years, pressure has been building for a commercial path to a stable supply of high-assay low-enriched uranium (HALEU)—deemed essential for the deployment of advanced power reactors—but advanced reactor developers and enrichment companies are still watching and waiting. In contrast, the uranium spot price soared after Sprott Physical Uranium Trust, a Canadian investment fund formed in July, began buying up U3O8 supplies, causing the price to increase over 60 percent, topping $50 per pound for the first time since 2012. Fueled by growing acknowledgment that nuclear power is a necessary part of a clean energy future, uranium is the focus of attention from Wall Street to Capitol Hill.