GLE picks natural U over HALEU for now, and more updates from U.S. enrichers

On March 26, Silex Systems Ltd. announced that Global Laser Enrichment’s test loop pilot demonstration facility and operational safety programs have been reviewed by the Nuclear Regulatory Commission and approved for loading uranium hexafluoride feed material in preparation for the next phase of GLE’s enrichment technology demonstration in the second quarter of 2024.

GLE wants to participate in the U.S. nuclear fuel supply chain, but not—in the near-term—as a supplier of the high-assay low-enriched uranium (HALEU) that future advanced reactors will require. That’s according to a separate March 25 announcement from Silex that GLE would not respond to the Department of Energy’s request for proposals for HALEU enrichment issued in January. Instead, GLE will stick with “its first commercial priority of establishing the Paducah Laser Enrichment Facility (PLEF) for production of natural grade uranium hexafluoride (UF6).”

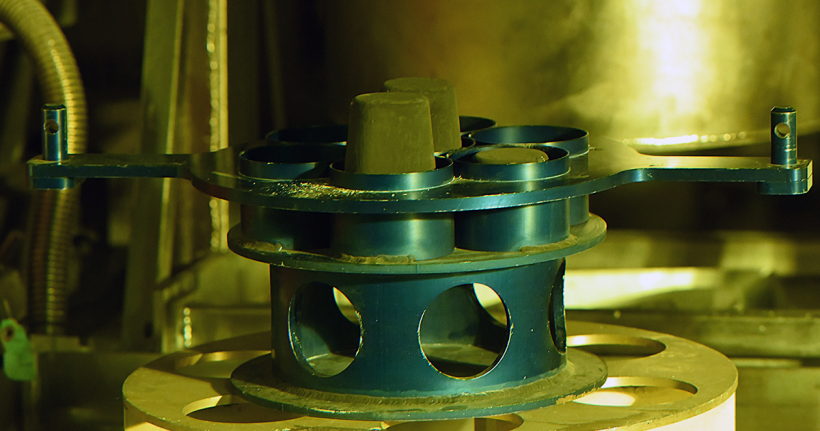

Testing moves ahead: GLE is owned by Silex and Cameco and is the licensee of the laser uranium enrichment technology that Silex developed in Australia. Under a calendar year 2024 plan and budget announced February 19, GLE is implementing a demonstration of the Silex technology at the test loop pilot facility at its headquarters in Wilmington, N.C.; working to acquire a site in Paducah, Ky; preparing an NRC license application for the PLEF; and commissioning a new GLE corporate headquarters and manufacturing facility in Wilmington.

According to Silex, NRC approval clears the way for Technology Readiness Level-6 enrichment testing and completion of a technology demonstration project by the end of the year. That is all part of a plan—subject to the successful completion of the TRL-6 pilot demonstration project, industry and government support, a feasibility assessment for the PLEF, suitable market conditions, and “other factors”—that “preserves the option to commence commercial operations at the planned PLEF in Kentucky as early as 2028.”

The natural choice: At the PLEF, GLE plans to enrich over 200,000 metric tons of depleted tails that GLE acquired from the DOE in 2016 to the natural uranium equivalent of about 0.7 percent U-235. GLE plans to produce natural uranium at a rate equivalent to the production of around 5 million pounds of natural uranium a year for approximately 30 years. The PLEF site could later host production of low-enriched uranium and HALEU—enrichment possibilities that Silex says “are not necessarily sequential by nature. The order of priority for deployment will depend on government and industry support and market factors.”

While GLE is not planning to respond to the DOE’s RFP for HALEU enrichment, the company will “actively assess additional opportunities for industry and government support to potentially accelerate commercial deployment of the Silex technology at the planned PLEF.” That support could include a potential $100 million DOE funding opportunity announcement to support novel enrichment technology, which GLE expects will be published this year.

News from other enrichers: Others in a small but varied field of U.S. enrichers (or potential enrichers) have also announced developments recently.

LIS Technologies Inc.—LIST, another company pursuing laser enrichment, but with a U.S.-patented technology called CRISLA (condensation repression isotope selective laser activation), announced March 25 that it had closed an oversubscribed $1.3 million seed funding round.

According to Christo Liebenberg, chief executive officer of LIST, “This investment will partially fund Phase 0 of our 4-step phased approach and mission to rejuvenate laser enrichment capabilities in the U.S. and breathe new life into the CRISLA technology, optimized for LEU and HALEU nuclear fuel.”

Urenco—Urenco USA, which operates the only commercial enrichment facility in the United States currently in production, recently announced that the NRC on March 8 accepted its License Amendment Request to increase enrichment levels from 5.5 percent to 10 percent, with a final decision expected by the end of 2024. Uranium enriched between 5 and 10 percent U-235 can be categorized as HALEU and also as LEU+.

Urenco’s U.S. operations began in New Mexico in 2010. On March 15, Urenco USA announced that it had just enriched its 50 millionth separative work unit of uranium—an amount that, according to the company, could power every home in the United States for three years.

Centrus—Centrus delivered its first 20 kilograms of HALEU UF6 in November 2023, completing Phase 1 of its DOE contract under budget and ahead of schedule. When Centrus announced its 2023 year-end results on February 8, however, the company noted that the Phase 2 production of 900 kilograms of HALEU UF6 could be delayed until the DOE provides 5B storage cylinders to collect the output of the HALEU demonstration cascade. According to Centrus, “Supply chain challenges have created difficulties for the DOE in securing 5B cylinders for the entire production year,” and that while those delays are anticipated to be temporary, the company “no longer will deliver 900 kilograms of HALEU UF6 originally anticipated for Phase 2 of the contract, which extends to November 2024.”