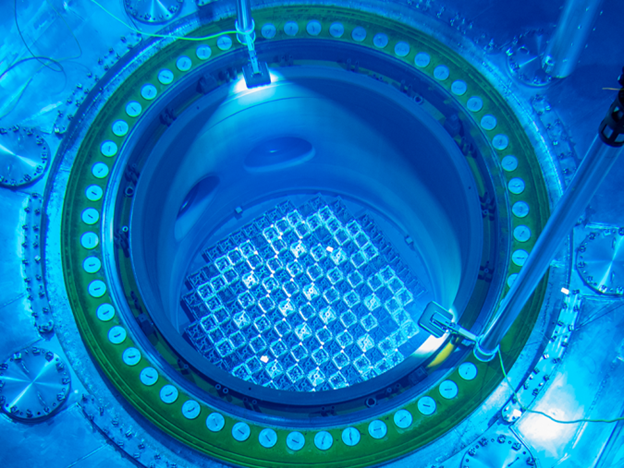

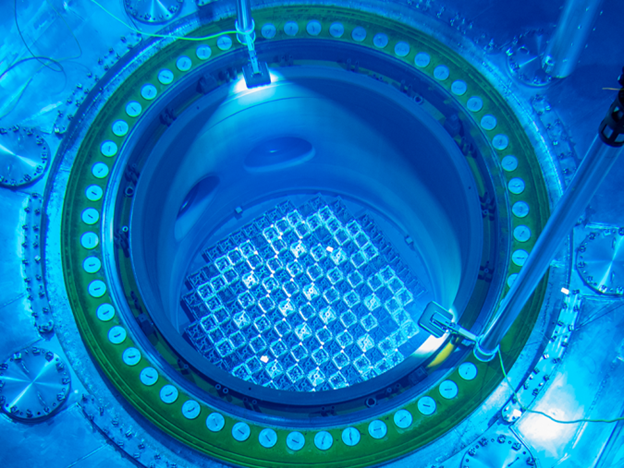

Higher enriched nuclear fuel being tested at Vogtle

Southern Nuclear recently loaded nuclear fuel with uranium-235 enriched up to 6 percent—higher than the usual 3–5 percent enrichment—into Vogtle-2 to test it through irradiation.

A message from Goodway Technologies

Optimizing Maintenance Strategies in Power Generation: Embracing Predictive and Preventive Approaches

Southern Nuclear recently loaded nuclear fuel with uranium-235 enriched up to 6 percent—higher than the usual 3–5 percent enrichment—into Vogtle-2 to test it through irradiation.

The latest edition of Uranium 2024: Resources, Production and Demand, commonly known as the Red Book, reports that current uranium resources are sufficient to meet low- and high-growth nuclear capacity needs through 2050 and beyond, but that further development of resources is still required. Even if nuclear capacity remains stable at 2050 levels through the end of the century, the report noted that cumulative demand “could exceed the current identified uranium resource base of nearly 8 million tonnes by the 2080s under the low-growth demand scenario and by the 2110s under the high-growth demand scenario outlined in this edition.”

The latest edition of Uranium 2024: Resources, Production and Demand, commonly known as the Red Book, reports that current uranium resources are sufficient to meet low- and high-growth nuclear capacity needs through 2050 and beyond, but that further development of resources is still required. Even if nuclear capacity remains stable at 2050 levels through the end of the century, the report noted that cumulative demand “could exceed the current identified uranium resource base of nearly 8 million tonnes by the 2080s under the low-growth demand scenario and by the 2110s under the high-growth demand scenario outlined in this edition.”

The Department of Energy has announced its first round of conditional commitments to provide high-assay low-enriched uranium to five U.S. nuclear developers. According to the DOE, the delivery of HALEU will support the commercialization of advanced nuclear technologies, aiming to deliver secure, affordable, and reliable energy to Americans.

Servis

Scientists at Argonne National Laboratory are investigating a used nuclear fuel recycling technology that could lead to a scaled-down and more efficient approach to metal recovery, according to a recent news article from the lab. The research, led by Argonne radiochemist Anna Servis with funding from the Department of Energy’s Advanced Research Projects Agency–Energy (ARPA-E), could have an impact beyond the nuclear fuel cycle and improve other high-value metal processing, such as rare earth recovery, according to Argonne.

The research: Servis’s work is being carried out under ARPA-E’s CURIE (Converting UNF Radioisotopes Into Energy) program. The specific project—Radioisotope Capture Intensification Using Rotating Packed Bed Contactors—started in 2023 and is scheduled to end in January 2026.

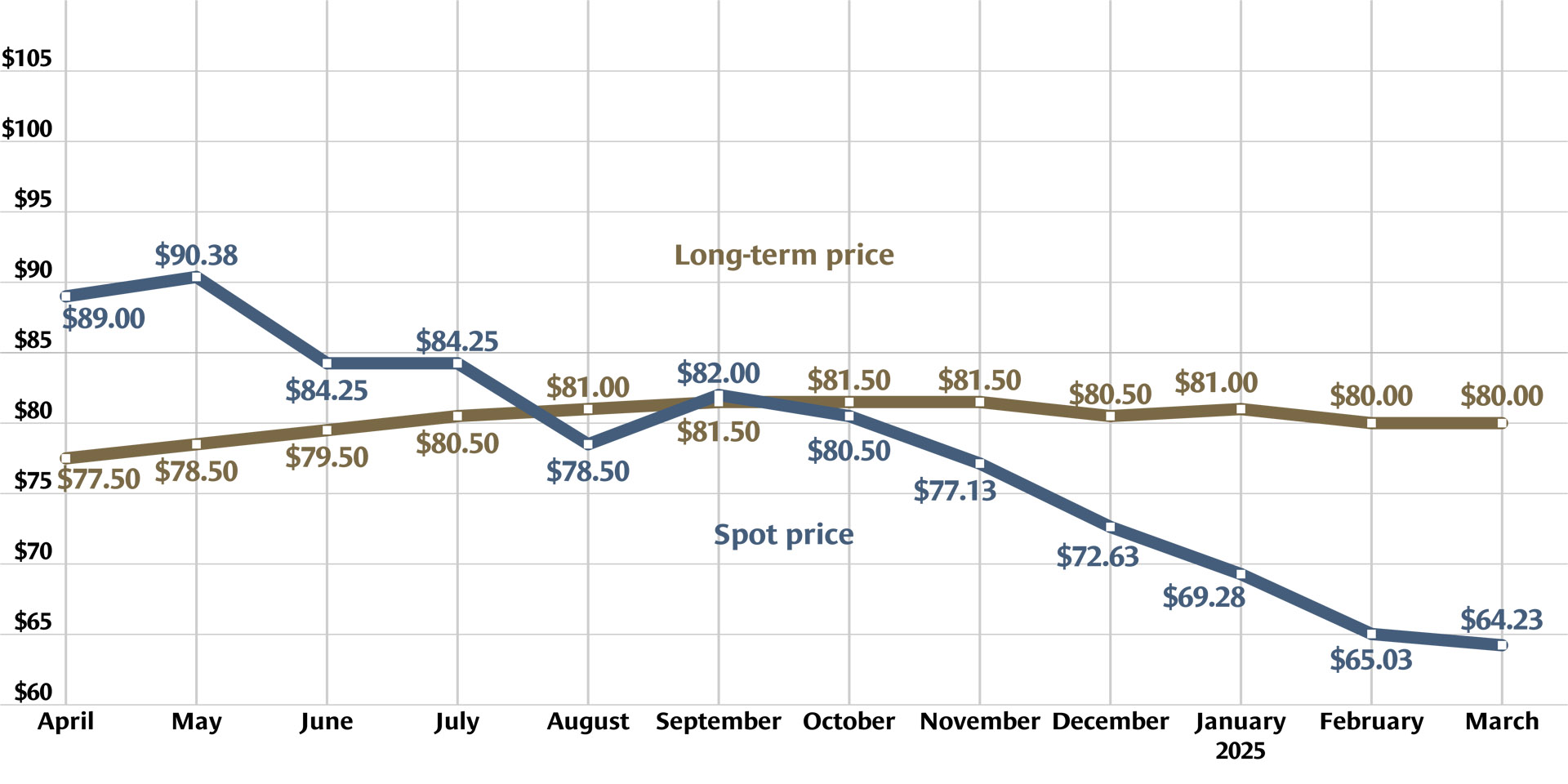

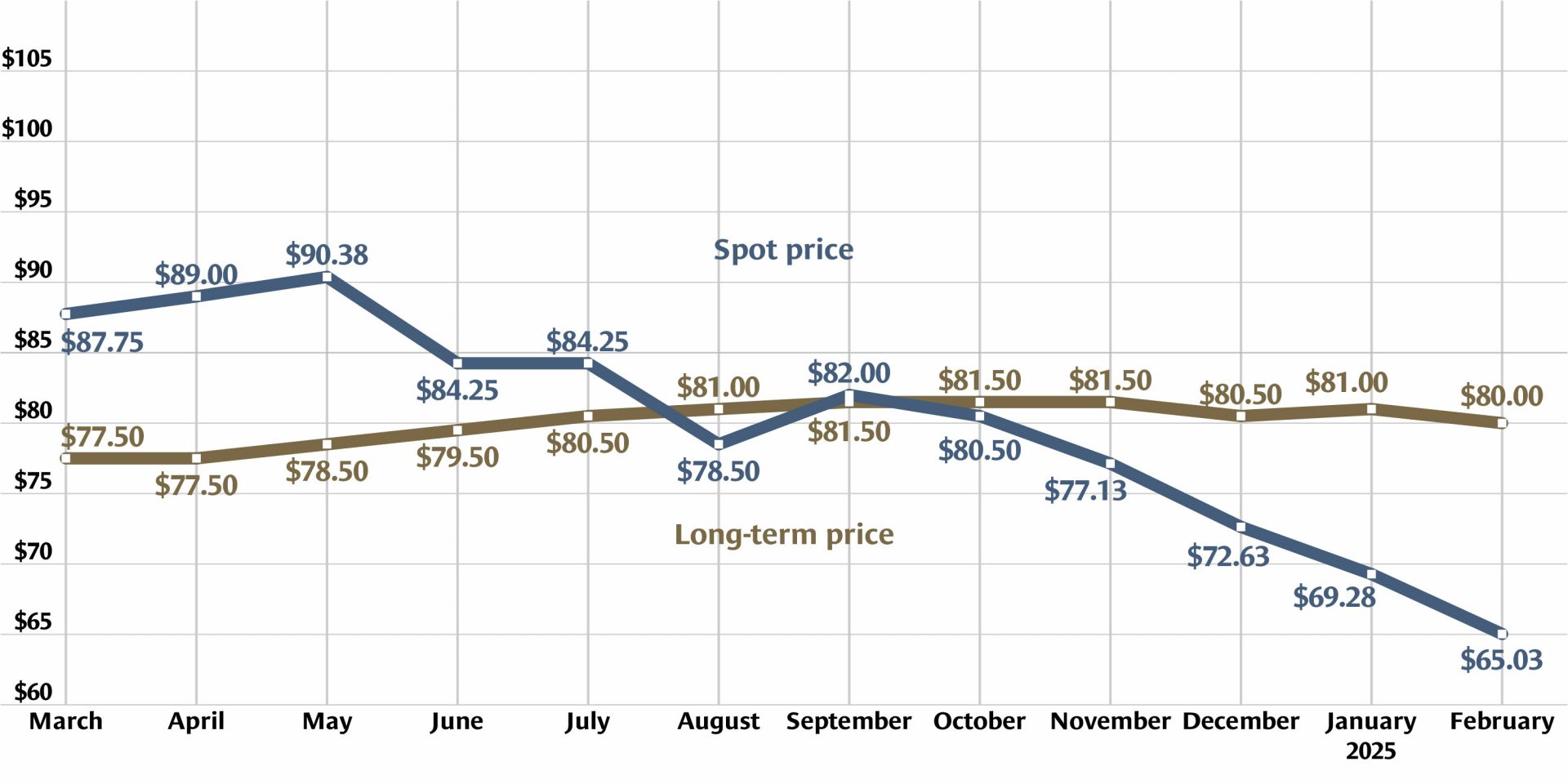

A combination of plentiful supply and uncertain demand resulted in spot pricing for uranium closing out March below $64 per pound, with dips down to about $63.50 during mid-March—the lowest price in 18 months, according to tracking by analysis firm Trading Economics. Spot prices have also fallen steadily since the beginning of 2024. Meanwhile, long-term prices have held steady at about $80 per pound at the end of March, according to Canadian front-end uranium mining, milling, and conversion company Cameco.

Melbye

During an interview for Kitco News at the 2025 Prospectors & Developers Association of Canada (PDAC) Convention, held in Toronto in early March, the chief executive of British Columbia–based Uranium Royalty Corp. noted, “I’ve never seen a better narrative around nuclear power [and] uranium.”

CEO Scott Melbye, who is also executive vice president of Texas-based Uranium Energy Corp. and has 41 years of experience in the uranium sector, added that nuclear energy has gone from stagnation or decline to a point where it may double by 2040.

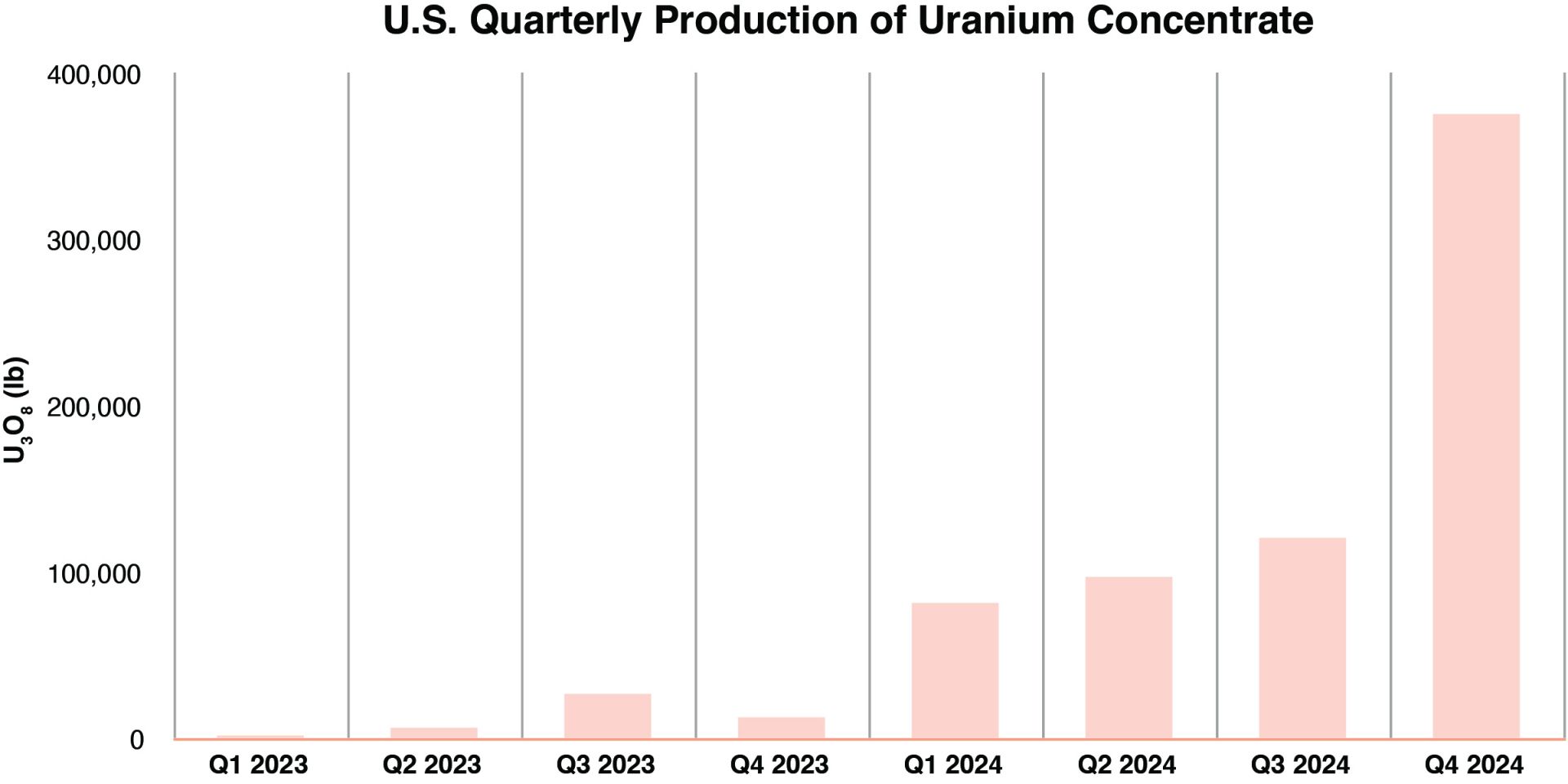

U.S. uranium production increased throughout 2024, with more growth planned in 2025. The producers who can make that happen, however, were burned before by a “renaissance” that didn’t take off. Now they are watching and waiting for signals from Washington, D.C., including the impacts of tariffs, shifting relationships with global uranium producers, and funding for the enrichment task orders designed to boost demand for U.S. uranium.

Idaho National Laboratory recently conducted a safety test on high-burnup fast reactor fuel from historic irradiation testing at the lab’s Experimental Breeder Reactor-II (EBR-II). According to the Department of Energy, which announced the work March 12, it’s the first such safety test to be performed in over 20 years.

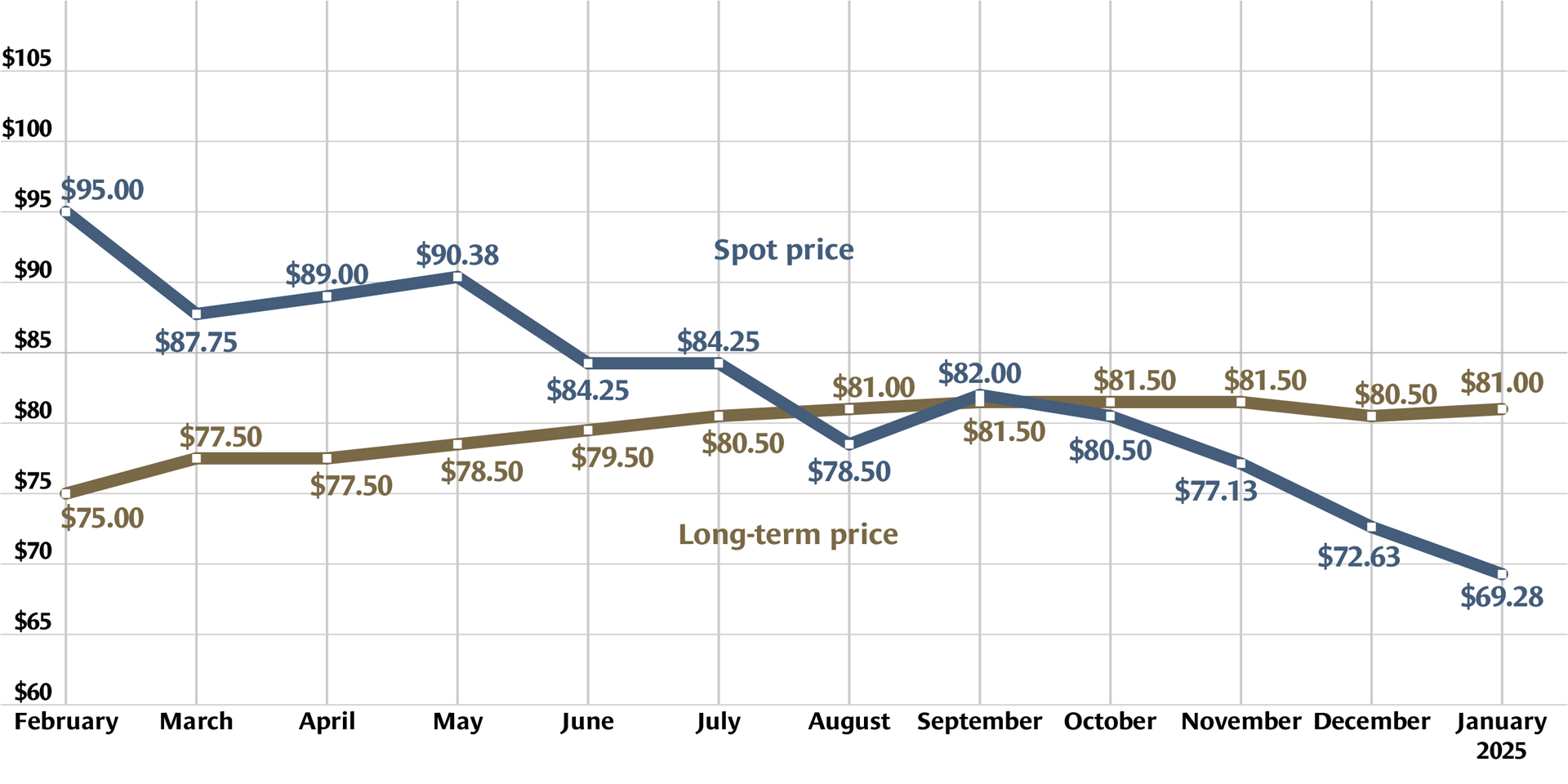

Uranium futures closed out February at about $65.55 per pound, according to online analysist firm Trading Economics. Futures prices have been below $66 per pound since mid-February.

Uranium futures took a sharp plunge below $69 per pound in late January, to a low of about $67 on January 27, before climbing back to $71.35 on January 31, according to Trading Economics. The New York City–based analyst firm noted that this was the market’s first drop below $69 in 16 months and that the price fluctuation happened as “markets recalibrated demand expectations against a backdrop of ample supply.”

Denver-based Energy Fuels Inc., one of the largest uranium producers in the United States, has signed a landmark agreement with the Navajo Nation on the transport of uranium ore along federal and state highways that cross through Navajo land. The agreement allows the resumption of uranium ore transport from Energy Fuels’ Pinyon Plain Mine in northern Arizona to the company’s White Mesa Mill in southern Utah, where the ore is processed into natural uranium concentrates (U3O8).

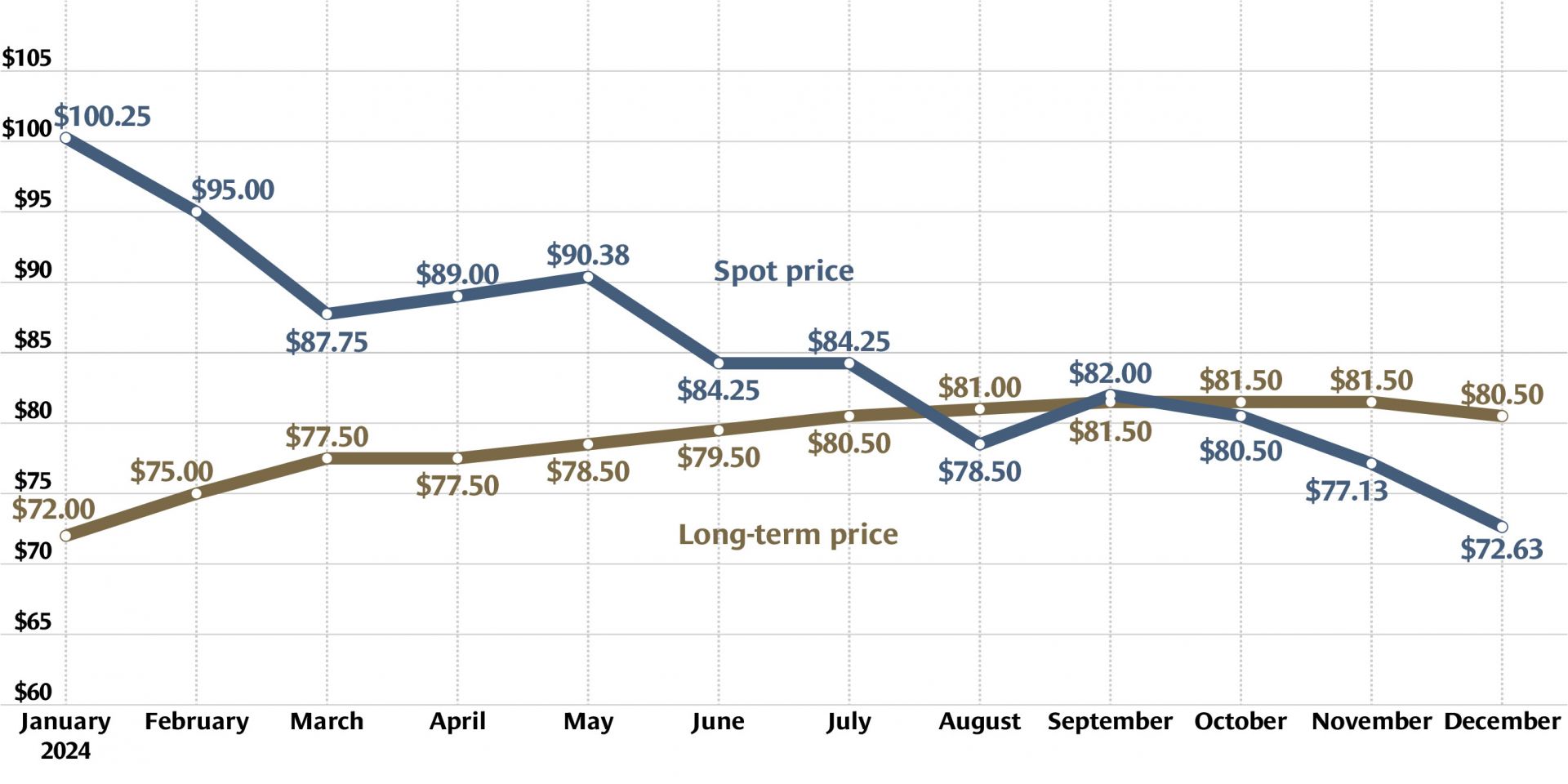

The uranium market closed out 2024 with a spot price of $72.63 per pound and a long-term price of $80.50 per pound, according to global uranium provider Cameco.

The Department of Energy has offered up to $80 million of Inflation Reduction Act funding to back potential advancements in high-assay low-enriched uranium production. The new funding opportunity, announced in December, will prioritize technological advancement developing innovative technologies and approaches to strengthen the front-end of the HALEU supply chain. Applications are due by 5:00 p.m. (EST) on February 26, 2025.

Just one day after Urenco USA (UUSA) was picked by the Department of Energy as one of six contractors eligible to compete for future low-enriched uranium task orders, the Nuclear Regulatory Commission on December 11 formally approved the company’s license amendment request to boost uranium enrichment levels at its Eunice, N.M., enrichment facility to 10 percent fissile uranium-235—up from its current limit of 5.5 percent.

The Department of Energy announced yesterday the six companies that it has selected to supply low-enriched uranium (LEU) from new domestic enrichment sources under future contracts for up to 10 years. The contract recipients are: Centrus Energy’s American Centrifuge Operating, General Matter, Global Laser Enrichment (GLE), Laser Isotope Separation Technologies (LIS Technologies), Orano Federal Services, and Urenco USA’s Louisiana Energy Services.

General Atomics Electromagnetic Systems (GA-EMS) announced last week that unfueled test rods featuring the company’s SiGA fuel cladding—made of a silicon carbide composite material—successfully survived 120 days of irradiation in the Advanced Test Reactor (ATR) at Idaho National Laboratory.

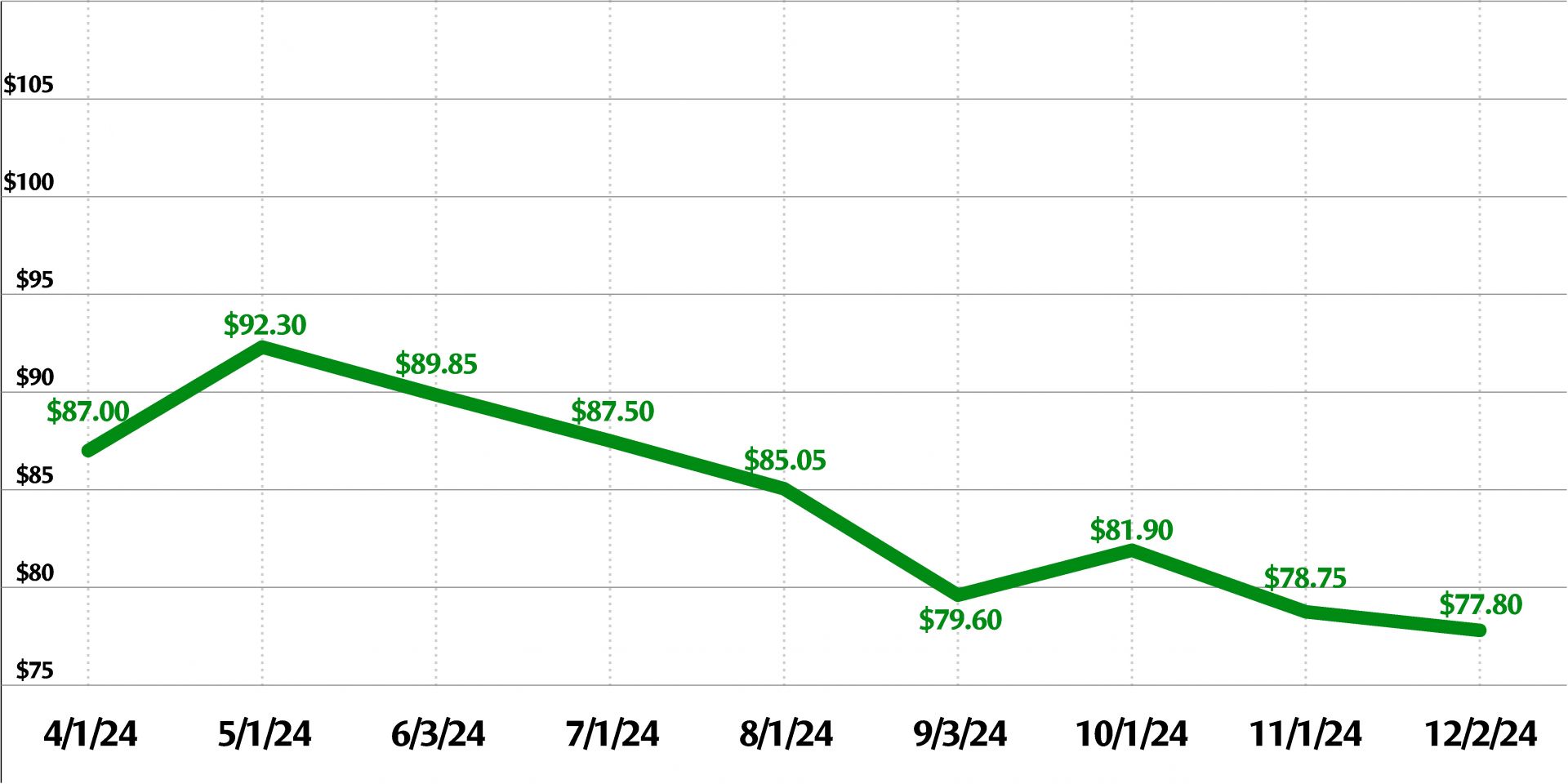

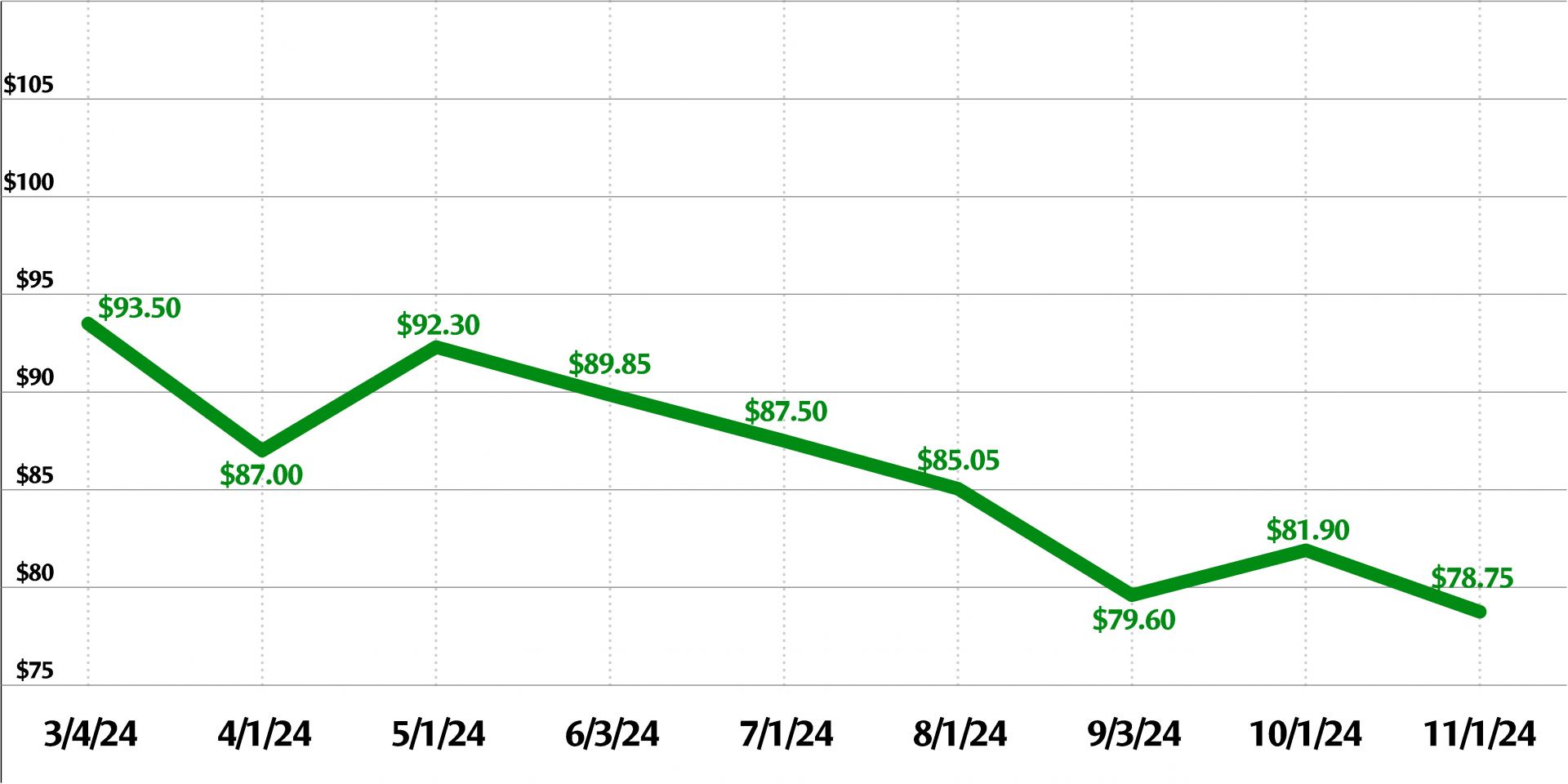

New York City–based analyst firm Trading Economics has reported that uranium prices have fallen $13.20 per pound, or 14.51 percent, since the beginning of 2024, with the price on December 3 down to $77.80 per pound. A graph of prices for the year shows a jagged downward slide since a peak of about $107 per pound in early February. The all-time high for uranium prices was $148 per pound in May 2007, according to the firm.

The Department of Energy announced November 19 that up to $16 million is available through a new High-Assay Low-Enrichment Transportation Package funding opportunity to research, develop, and acquire Nuclear Regulatory Commission licensing for transportation of HALEU—using new or modified packages.

Clean Core Thorium Energy (Clean Core) announced November 12 that test rodlets of its patented thorium-uranium fuel design known as ANEEL (advanced nuclear energy for enriched life) have reached a burnup milestone in the Advanced Test Reactor (ATR) at Idaho National Laboratory.

Uranium prices have fallen to their lowest level in more than a month, to just under $79 per pound, on Friday, November 1, according to analyst website Trading Economics. The lower prices, according to the site, are related to recent evidence of increased supply. This contrasts with the longer-term expectations of bullish demand and higher prices.