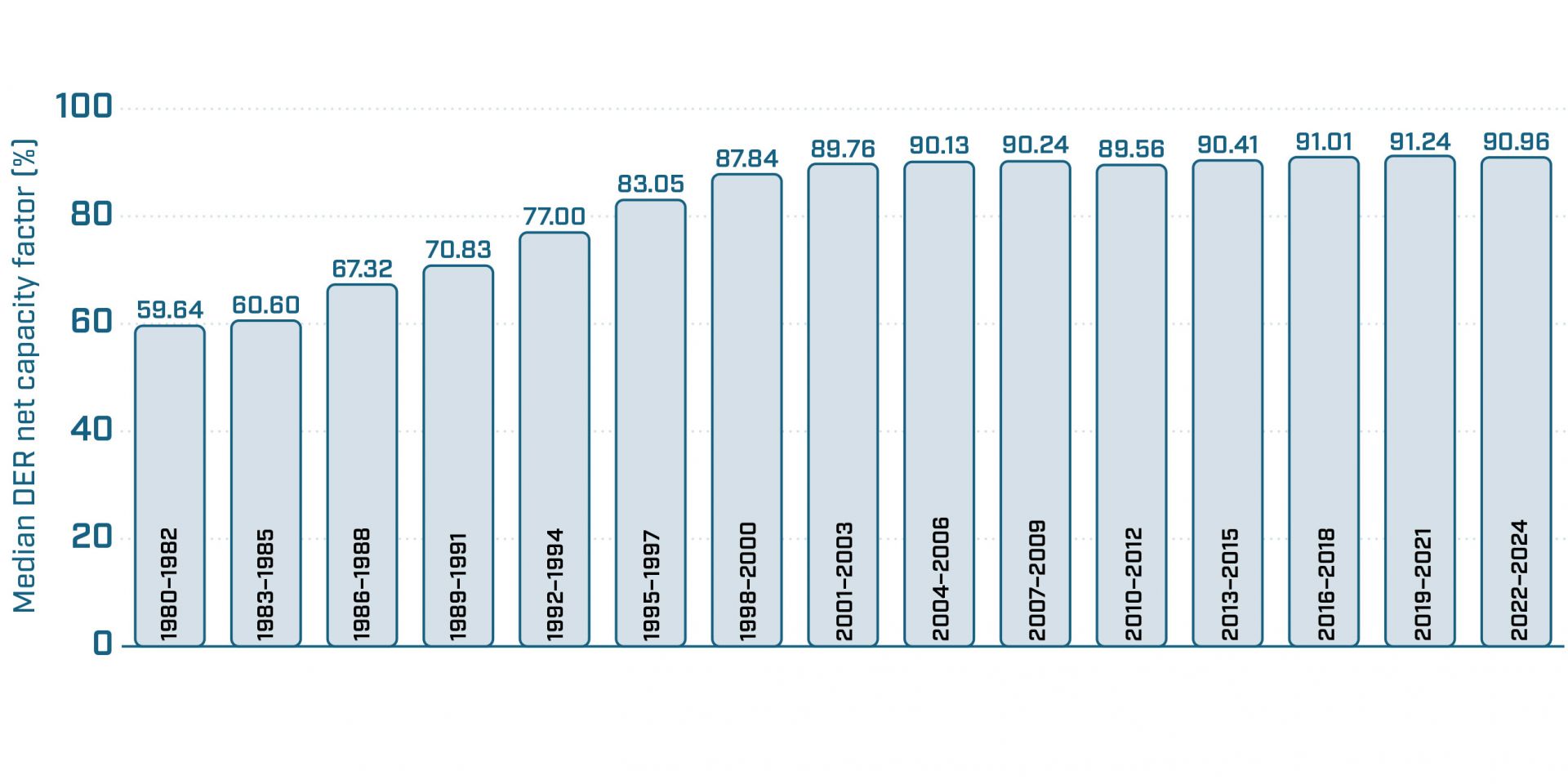

Fig. 1. Median capacity factor of all reactors. The median DER net capacity factor of the 92 reactors included in this survey for the three-year period 2022–2024 is 90.96 percent. The 92 reactors in this survey are being compared with 94 reactors in 2019–2021 (when Indian Point-3 and Palisades were also included); 98 in 2016–2018; 99 in 2013–2015. There were 104 reactors in the five three-year periods prior to that. There were 53 reactors in the database in 1980–1982, and in the five subsequent periods there were 60, 77, 97, 102, and 103.

Nuclear generation has inertia. Massive spinning turbines keep electricity flowing during grid disturbances. But nuclear generation also has a kind of inertia that isn’t governed by the laws of motion.

Starting—and then finishing—a power reactor construction project requires significant upfront effort and money, but once built a reactor can run for decades. Capacity factors of U.S. reactors have remained near 90 percent since the turn of the century, but it took more than a decade of improvements to reach that steady state. The payoff for nuclear investments is long-term and reliable.

The Susquehanna nuclear power plant. (Photo: Talen)

The Federal Energy Regulatory Commission has denied plans for Talen Energy to supply additional on-site power to an Amazon Web Services’ data center campus from the neighboring Susquehanna nuclear plant in Pennsylvania.

Diablo Canyon nuclear plant. (Photo: PG&E)

Last April, Entergy had to close its Indian Point nuclear plant. That’s despite the plant’s being recognized as one of the best-run U.S. nuclear plants. That’s also despite its 20-year license extension process having been nearly completed, with full support from the Nuclear Regulatory Commission.

This closure was due in large part to opposition by antinuclear environmental groups. These groups also mobilized existing negative public opinion on nuclear energy to get politicians to oppose the plant’s license extension. Another factor is unfair market conditions. Nuclear energy doesn’t get due government support—unlike solar, wind, and hydro—despite delivering clean, zero-emissions energy.