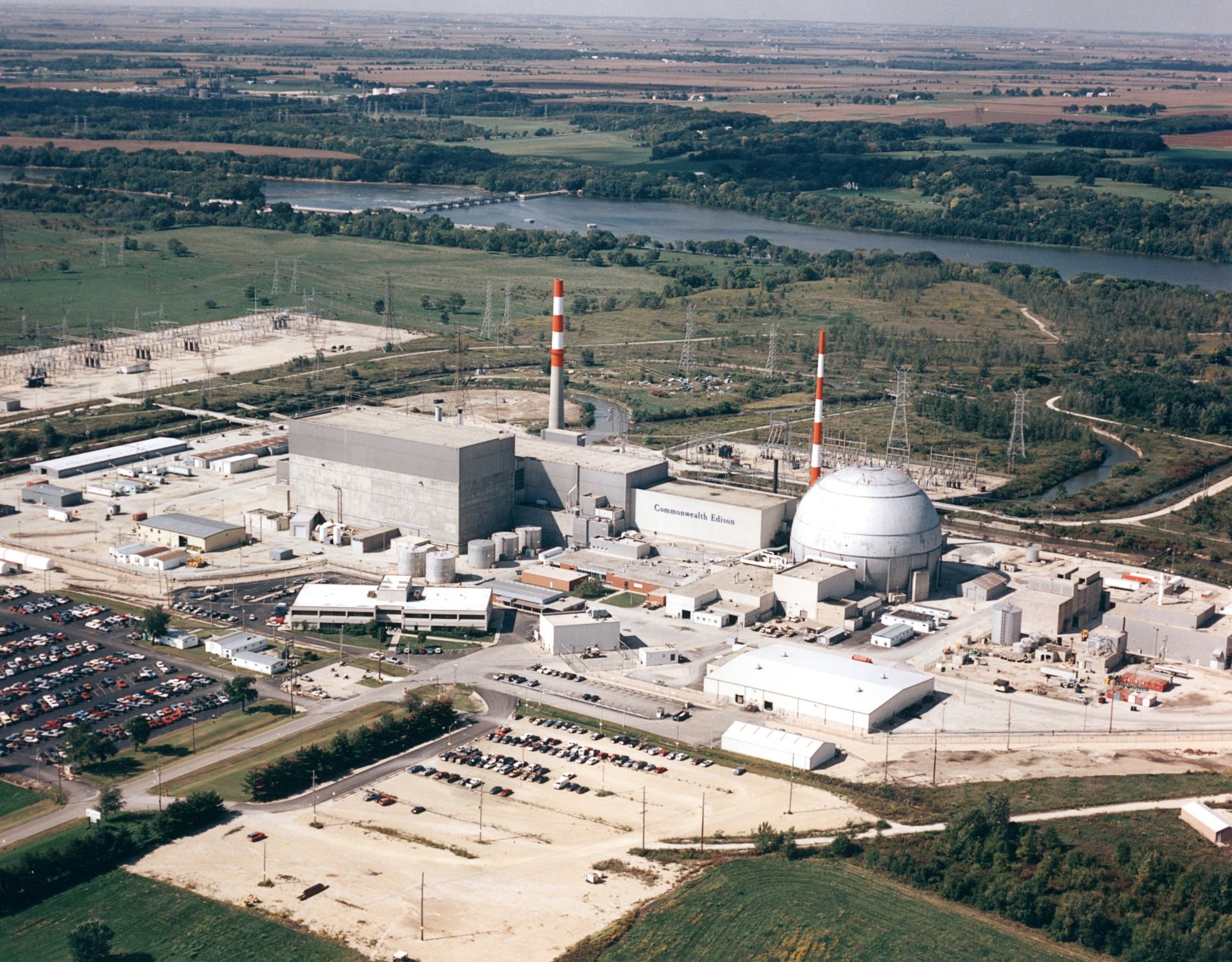

Dresden nuclear power plant. (Photo: Constellation Energy)

Constellation Energy has filed with the Nuclear Regulatory Commission for a subsequent license renewal for its Dresden nuclear power plant in Illinois. The extension would allow Dresden to run through 2051.

The filing begins a comprehensive, multiyear review by the NRC. Unit 2 is currently licensed to operate through 2029 and Unit 3 through 2031. The facility’s license was first renewed by the NRC in 2004.

Clinton nuclear power plant. (Photo: Constellation Energy)

The Nuclear Regulatory Commission has published Clinton Power Station’s initial license renewal on the agency’s website.

Constellation Energy submitted the application February 14, seeking an extension for the Illinois plant's current operating license from 20 years to 40 years. This would allow the Illinois plant to run through 2047.

Clinton nuclear power plant, located near Clinton, Ill. (Photo: Constellation)

Constellation Energy is asking the Nuclear Regulatory Commission for an initial license renewal for its Clinton nuclear plant in Illinois, which would allow the facility to operate through 2047.

This move is not unexpected from Constellation, the largest producer of nuclear power in the United States. The vast majority of nuclear plants in the United States have already been approved for their first 20-year renewal term. Clinton, which came on line in 1987, is one of the nation’s “newer” plants.

Kyle Hill appreciates a Dresden nuclear waste cask. (Photo: Kyle Hill)

On this holiday that celebrates all things love, here’s a look at the love affair that Kyle Hill has with nuclear energy—even its waste.

The U.S. Treasury Department building in Washington, D.C.

Two weeks remain for public comments on the proposed language in the new federal rules proposed for hydrogen production tax credits. A public hearing on the regulations is scheduled for March 25, 2024.

While the federal proposal is largely popular among environmentalists and some pronuclear advocates, there are concerns from others that it would cut out opportunities for existing legacy nuclear plants that are well-equipped to convert part of their operations to hydrogen production. The proposed rules require hydrogen to come from newly built resources—the largest obstacle for legacy nuclear sites but further incentive to deploy new reactors—and would permit using natural gas if employed with carbon capture and sequestration.

The Zion nuclear plant site as it appeared earlier this year. (Photo: Tim Gregoire)

The Nuclear Regulatory Commission has released for “unrestricted use” most of the land on and around where the Zion nuclear power plant once operated in northeastern Illinois. This means that any residual radiation is below the NRC’s limits and there will be no further regulatory controls by the agency for that portion of the property.

The Byron nuclear power plant. (Photo: Constellation Energy)

Constellation Energy has announced an agreement with Commonwealth Edison (ComEd), Illinois’s largest electric utility, to power the latter’s 54 offices and metered facilities with locally produced nuclear energy, 24/7.

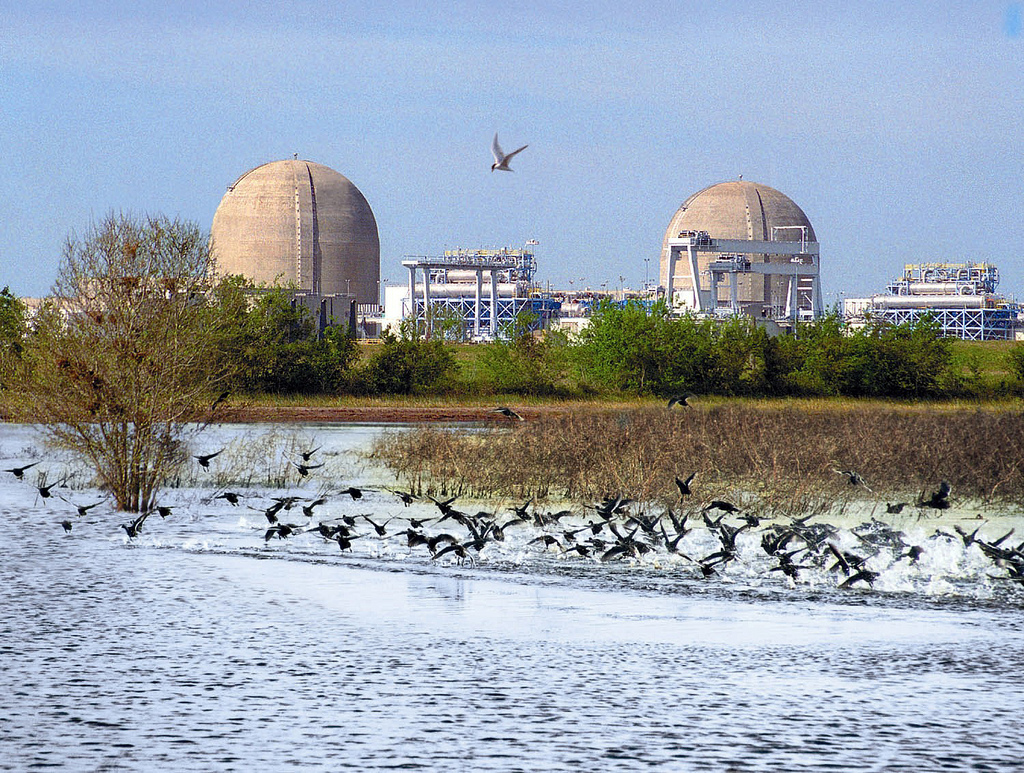

The South Texas Project nuclear power plant. (Photo: Wikipedia)

Constellation Energy, operator of the largest U.S. reactor fleet, is acquiring NRG Energy’s 44 percent ownership stake in the South Texas Project nuclear plant, the Baltimore, Md.–based company announced this morning.

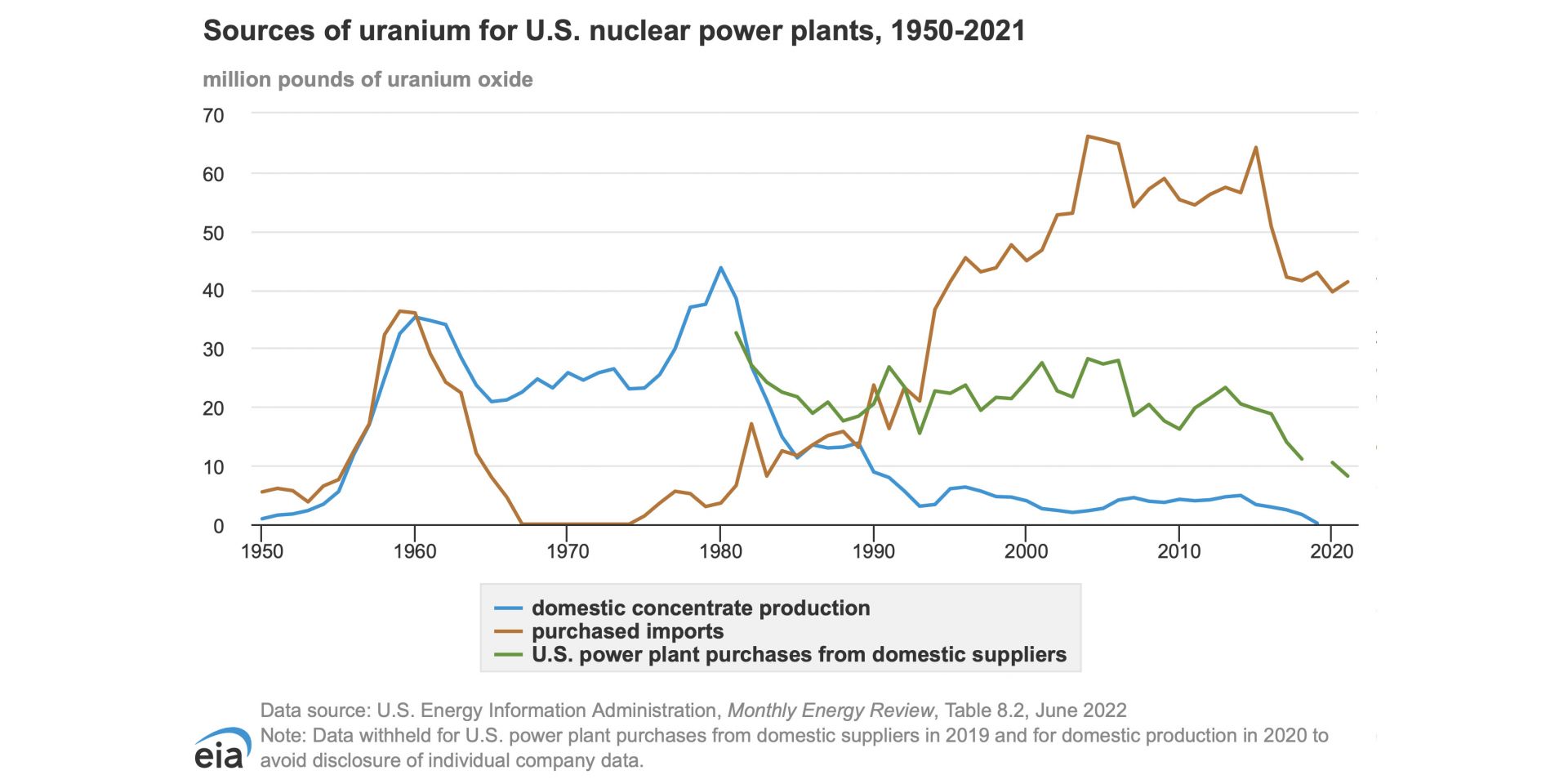

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

.jpg)