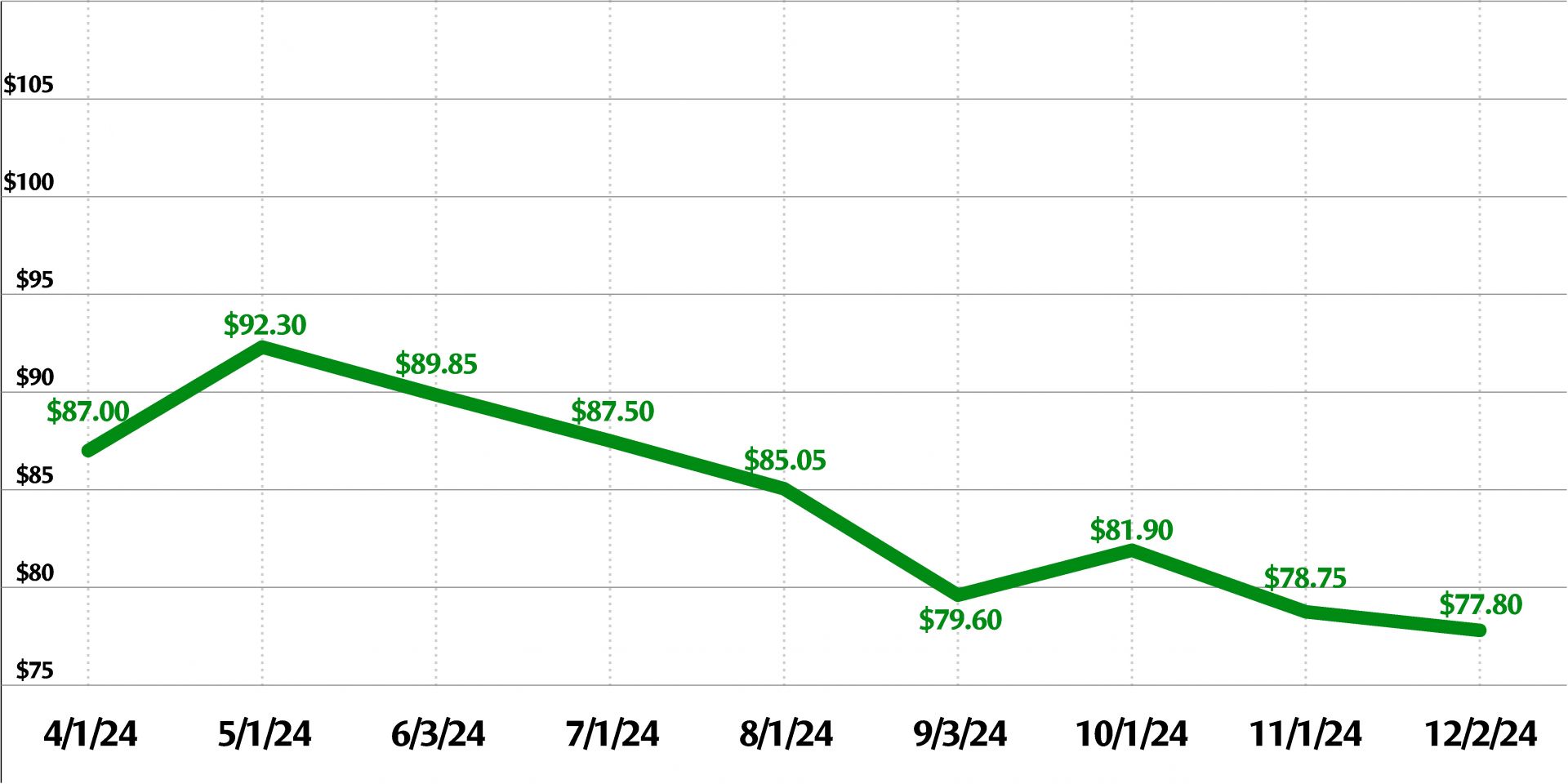

Trading Economics has predicted that uranium will trade at $78.10 per pound by the end of this year, with estimates that the price will increase to $79.95 at the end of next year.

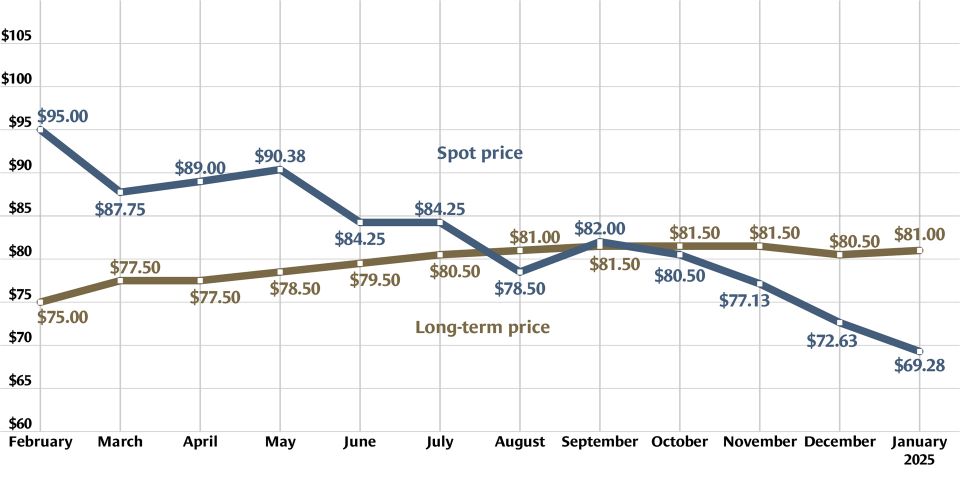

Poised for a comeback: An article on the Carbon Credits website from mid-October noted that “uranium prices may have dropped recently, but the long-term outlook for this critical energy resource is glowing. With game-changing technologies on the horizon and new uranium projects underway, the market is on for an exciting comeback.”

The article explained that BMO Capital Markets, the investment banking subsidiary of BMO Financial Group, “projects a strong outlook for uranium demand.” According to BMO Capital Markets, uranium demand is expected “to grow at an annual rate of 2.9% through 2035. This increase is largely driven by China’s aggressive push to build new nuclear reactors and the potential for reactor restarts in North America.”

The article continued, “While uranium prices remain below the peak seen earlier in 2024, the general trend suggests a robust market with significant upside potential, particularly as nuclear energy plays an increasingly vital role in global energy strategies.” Described in the article is the promise of small modular reactors, government and corporate investment in uranium enrichment, and global interest in reducing carbon emissions.

“BMO Capital Markets’ analysis shows that the demand for uranium will continue to rise,” according to Carbon Credits. “While supply-side challenges remain, the potential for significant uranium production growth offers hope for balancing demand. With recent market development, the future of uranium looks bright, offering solutions to the world’s energy challenges.”