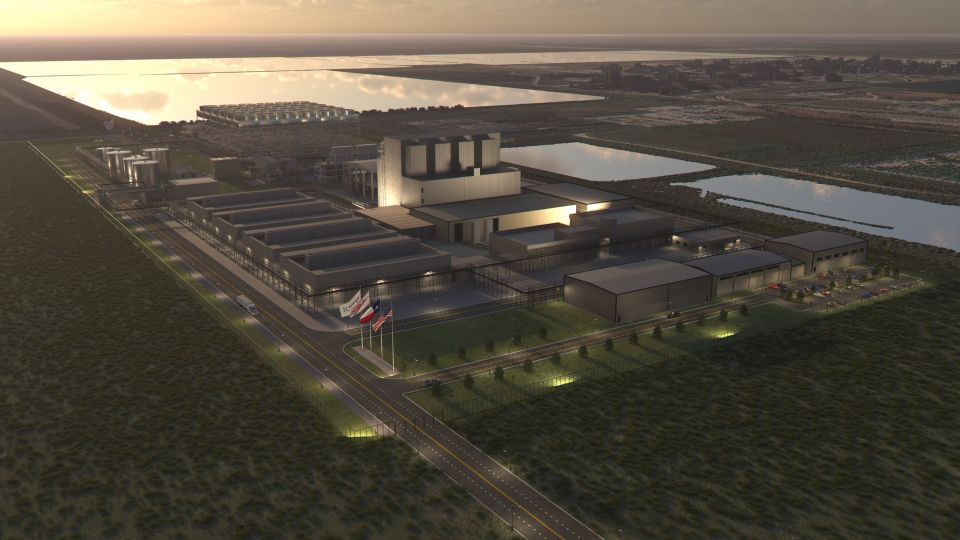

The DOE picks six HALEU deconverters. What have we learned?

The Department of Energy announced contracts yesterday for six companies to perform high-assay low-enriched uranium (HALEU) deconversion and to transform enriched uranium hexafluoride (UF6) to other chemical forms, including metal or oxide, for storage before it is fabricated into fuel for advanced reactors. It amounts to a first round of contracting. “These contracts will allow selected companies to bid on work for deconversion services,” according to the DOE’s announcement, “creating strong competition and allowing DOE to select the best fit for future work.”

-3 2x1.jpg)