Reasons: Trading Economics attributes the recent price increase to perceived “risks to supply coincid[ing] with robust power demand for major nuclear energy producers.” Russian president Vladimir Putin recently stated that his government is considering banning exports of uranium, an action that would counter Western sanctions against the country as well as the U.S. government’s decision to allow some Russian uranium contracts to remain despite an American ban on imports of nuclear fuel from Russia.

China: Developments in China have added to the bullish market for uranium. The Chinese government has enacted a series of stimulus packages for nuclear energy, and there has been an overall improved investment outlook for China’s economy associated with its moves to expand nuclear energy. There are currently 28 nuclear reactors under construction in China, according to the International Atomic Energy Agency’s Power Reactor Information System database.

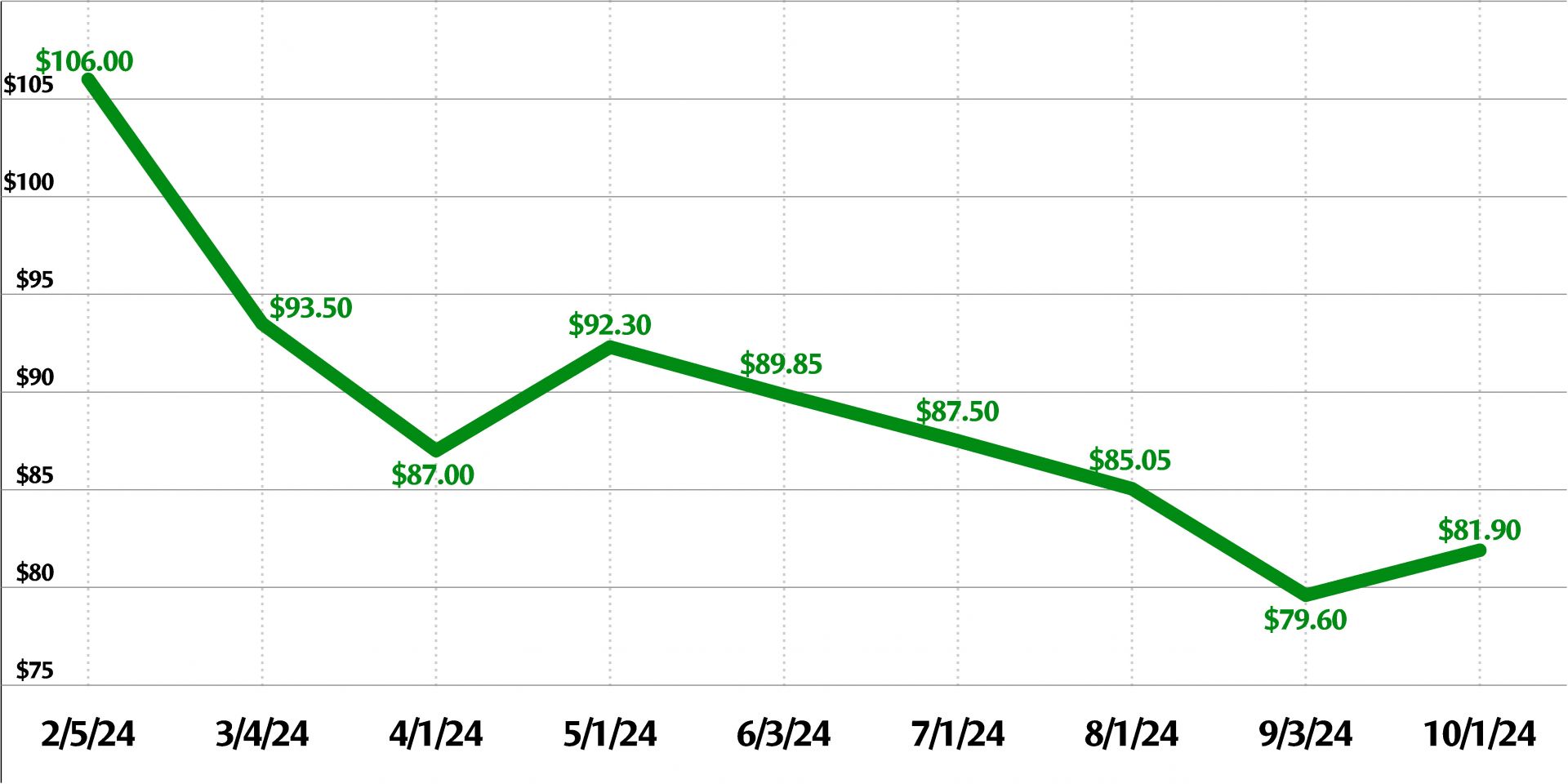

Growth: Uranium prices are expected to move higher by the end of this quarter, when Trading Economics’ global macro models and analyses forecast uranium to trade at $84.15 per pound. In another 12 months, the site estimates that uranium will be trading at $91.80 per pound.

-3 2x1.jpg)