China's ambitious nuclear energy program

Capacity planning targets keep going up

The latest dizzying numbers for China's planned construction of new nuclear reactors, released in early November by the country's National Development & Reform Commission, soared to 114 GWe by 2020. Chinese nuclear energy officials later said that 80 GWe was a more likely target.

The latest dizzying numbers for China's planned construction of new nuclear reactors, released in early November by the country's National Development & Reform Commission, soared to 114 GWe by 2020. Chinese nuclear energy officials later said that 80 GWe was a more likely target.

The new target represents a significant increase from a prior target of 70 GWe issued last May by Zhang Guobao, head of China's National Energy Administration. Reuters reported on November 23 that the China Nuclear Energy Association, headed by Zhao Chenkun, said that the 70 GWe target is too low. China currently has a reported 23 reactors under construction and another 140 on drawing boards in various stages of readiness to proceed.

According to the China Daily on November 12 , Geng Zhicheng, a spokesman for the commission, told a nuclear energy conference in Beijing that if this target (114 GWe) is met, nuclear power will account for just 7 percent of the nation's estimated need for 1600 GWe of power by 2020. According to Steve Kidd, of the World Nuclear Association, speaking at the same conference, China has targeted increasing total non-fossil energy to 15 percent of the total by 2020.

All three of China's state-owned nuclear energy companies are participating in the new build:

- China National Nuclear Corp.

- China Guangdong Nuclear Power Group

- State Nuclear Power Technology Corp.

Financing the tremendous growth in nuclear reactors will require a minimum of $1500-$2000/Kw based on the zero cost of capital for the state-owned firms. Even 40 GWe of new capacity will cost a staggering amount of money. The goals of 70 GWe, 80 GWe, or 114 GWe may require China to reallocate funds from other government entities. Energy security, however, is a top priority for China. Its form of government allows it to make such decisions without broad public consultations about spending.

That said, some analysts ask the relevant question of how will China be able to execute these ambitious plans. The target of 40 GWe by 2020 could involve at least 30 new reactors. Whether the nation can achieve a goal of building three times that number is an open question. China has set a course to achieve these goals. Here's what we know so far:

To achieve the new targets, the country will have to become self-sufficient in reactor design, fuel cycle, and workforce development, construction; as well as reprocessing of spent fuel and activities related to waste management. The country will also need to make significant investments in rail and road transportation infrastructure for reactors located inland away from coastal seaport serviced sites.

Reactor design

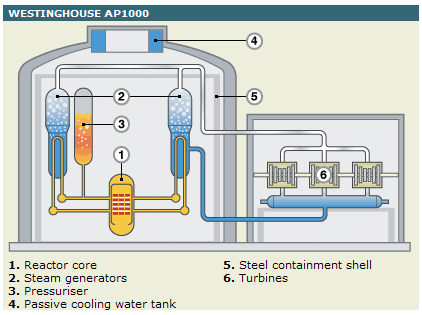

AP 1000 Schematic Image: BBC

China's reactor design of choice for this massive expansion will be based on the Westinghouse AP1000. According to the Financial Times on November 23, Westinghouse, which is owned by Japan's Toshiba Corp., delivered a huge collection of technical design documents to China as part of a technology transfer agreement signed three years ago. That agreement was the lubricant that moved a deal forward for Westinghouse to build four AP1000s in China. The first unit is scheduled to load fuel in 2013 with all four units in revenue service by 2015.

The Financial Times reported that at least 30 percent of the new reactors built in China in the next 10 years will be based on the AP1000 design. It will take years, however, for China to absorb the technology as well as train thousands of new engineers to master it. During this time, Westinghouse can expect to continue to be deeply involved in China's massive nuclear program. From a safety perspective, China will need Westinghouse know-how to ensure accidents don't derail its ambitious expansion plans. As a result, Westinghouse remains bullish that it will get more orders for new reactors from China.

Competition for market share

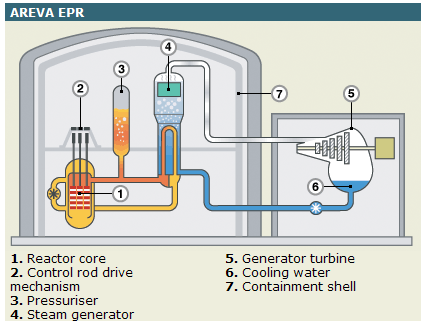

Areva EPR Schematic Image: BBC

There's competition for market share in China's nuclear new build. French state-owned Areva is building two 1600-MW EPR reactors at Taishan. The deal, signed in November 2007, calls for the fuel to be loaded and the reactor to be in revenue service in just over six years, or early 2014.

The Taishan site is expected eventually to host six of the French reactors. The degree of French and Chinese participation in the next two units is still in negotiation. The first two reactors are bundled into a deal involving uranium and fuel cycle facilities.

Areva will build new uranium enrichment and fuel reprocessing facilities in China. These are areas where Westinghouse is at a comparative disadvantage. Areva has signed long-term deals with China to supply the fuel for the new reactors and access to uranium production from Areva's mines in Canada.

Russia's AtomStroyexport has signed a deal for two new reactors, units 3 & 4, at China's Tianwan power station. The first two units were built by Russia and completed in 1997. The new units will likely be 1000-MW VVER light-water reactors. Further out are plans for units 5 and 6 being 1200-MW VVERs. Like Westinghouse and Areva, the Russians have promised China to "localize" the supply chain to the extent that domestic firms can meet demand and quality requirements.

While China built two medium-sized Candu-6 reactors from AECL, completing them in 2002 and 2004, it appears unlikely that it will seek additional Candu reactors. The Westinghouse PWR will become the basis for China's indigenous designs.

Workforce

According to an assessment by John Ritch, director-general of the World Nuclear Association, published on November 23, China will emphasize on-the-job training to develop skilled trades and reactor operators. Ritch said that China has the capability to develop the workforce necessary, including engineers, to run the new reactors.

According to an assessment by John Ritch, director-general of the World Nuclear Association, published on November 23, China will emphasize on-the-job training to develop skilled trades and reactor operators. Ritch said that China has the capability to develop the workforce necessary, including engineers, to run the new reactors.

According to the International Atomic Energy Agency, demand for nuclear talent in China is "huge" because of the development of nuclear power. Because of the long time needed to acquire the necessary expertise, many Chinese students choose to study computer science, business, manufacturing, and other disciplines rather than nuclear sciences.

Chinese education officials have told the IAEA that they realize there is no "instantaneous effective way to attract brilliant students to nuclear engineering."

The IAEA reported that major universities have introduced changes in nuclear engineering programs, as part of educational reforms, to attract more students. These include greater on-the-job training opportunities for students. In the short term, China expects to have more and extensive interaction with foreign universities and institutions associated with nuclear engineering and technology, through professional and information exchange programs.

Uranium

All those new reactors will need fuel.That means China will be importing a lot more uranium. According to forecasts from UxC Consulting cited in the Financial Times on November 25, China will boost its imports by an factor of four to 50-60 million pounds/year, or 25-30 percent of total global demand (190 million lb in 2010). China appears to be building a strategic stockpile of uranium. Domestic production is only 2 million lb/year. Key international suppliers include Kazakhstan, Australia, and Canada.

Supply Chain

Development of a supply chain of reactor components will require rapid development of domestic manufacturing capabilities that can meet nuclear quality standards. Industry experts say that China will seek to achieve ASME standards for its nuclear components. Key areas will include cooling pumps, digital instrument and control systems, steam generators, and large forgings.

The Shaw Group, which owns 20 percent of Westinghouse, has contracts in China to supply engineering and construction management services. Also, Shaw is building a factory in China to deliver components for China's massive new nuclear build.

Exports

Until recently, China has not shown any interest in commercial exports of nuclear reactor technology. It offered Pakistan two 300-MW reactors, but this transaction is seen as part of China's international posture relative to India, and not as a commercial venture.

Ling Ao II reactor is a CPR-1000 that can deliver 1080 MWe and has a design life of 60 years.

World Nuclear News reported on November 25 that by 2013, China Guangdong Nuclear Power Group (CGNPG) is planning to have available for export a Generation III design, which at 1000 MW would be a scaled-down version of the 1600-MW Areva EPR.

Zhang Shanming, president of CGNPG, told a conference held in Beijing sponsored by the World Nuclear Association (WNA) that the reactor will have a design life of 60 years and the target time and cost for delivery to a customer is 52 months at $1500/Kw.

China expects to negotiate clearances by 2013 with Areva and Westinghouse to use transferred technology in its export designs. If China can deliver the schedule and cost structure targets, it could become a competitor globally relative to Russia's expanding export program. China would have to demonstrate success with its domestic new build to gain the confidence of international customers.

Fast reactors

Longer term, China is pursuing development of fast breeder reactors that will generate more plutonium than they consume. This program will raise significant nonproliferation issues with any country that China contracts with for the technology.

The strategic intent of a fast breeder reactor program is based on the assumption that China will eventually face the same competition for uranium it now contends with for Mideast oil. A fleet of fast breeder reactors, coupled with fuel recycling centers, could give the nation a long-term supply of fuel.

Dow Jones News Wires reported on November 24 that China National Nuclear Corp. is working on a deal with Russia to import two 800-MW fast reactors to be installed at a site in Fujian province. It seems likely that these reactors will be used as platforms to test the commercial viability of fast reactor technologies.

China is also developing a 165-MW high-temperature, gas-cooled pebble bed reactor for commercial use especially in remote areas that are not connected to the national electric grid. The project was launched in October 2008 at Shandong

The challenges are that China has little experience with fast reactors and developing a a fuel cycle to supply them. In that regard, China has a lot in common with Western nations that see fast reactors as technology more likely to come online in the second half of this century. China's nuclear companies are thinking that far ahead. Are we?

----

Dan Yurman publishes Idaho Samizdat, a blog about nuclear energy. He is a contributing reporter for Fuel Cycle Week and a frequent contributor to ANS Nuclear Cafe.