Vistra, Energy Harbor deal finally closes

Vistra this week completed its acquisition of Energy Harbor Corp., a move the company announced almost exactly a year ago with a $3.43 billion price tag.

-3 2x1.jpg)

A message from Curtiss-Wright

High-Temperature neutron flux detectors for Generation IV reactors and SMRs

Vistra this week completed its acquisition of Energy Harbor Corp., a move the company announced almost exactly a year ago with a $3.43 billion price tag.

NRC looks to streamline hearing timelines under new rule

The Nuclear Regulatory Commission is set to expedite its Atomic Safety and Licensing Board adjudicatory hearings on most license applications, including those involving new reactors and...

Bowen to lead new Office of Advanced Reactors

Jeremy Bowen will head the newly created Office of Advanced Reactors when it launches in September, the Nuclear Regulatory Commission announced Monday.This new office will license and oversee...

NRC opens comment period for fusion regulatory changes

The Nuclear Regulatory Commission has taken the next step toward developing fusion regulations, announcing the opening of a 90-day comment period, ending May 27, on a proposed regulatory...

Workshop hints at robust support for nuclear expansion in Arizona

Palo Verde, with three reactors and a combined capacity of about 4,000 MWe, is the only nuclear power plant in Arizona. But that could very well change soon if state officials have their...

NRC posts hearing notice for Crane license amendments

Constellation has submitted an application with the Nuclear Regulatory Commission requesting three amendments to its renewed facility license to support the potential restart of Crane nuclear...

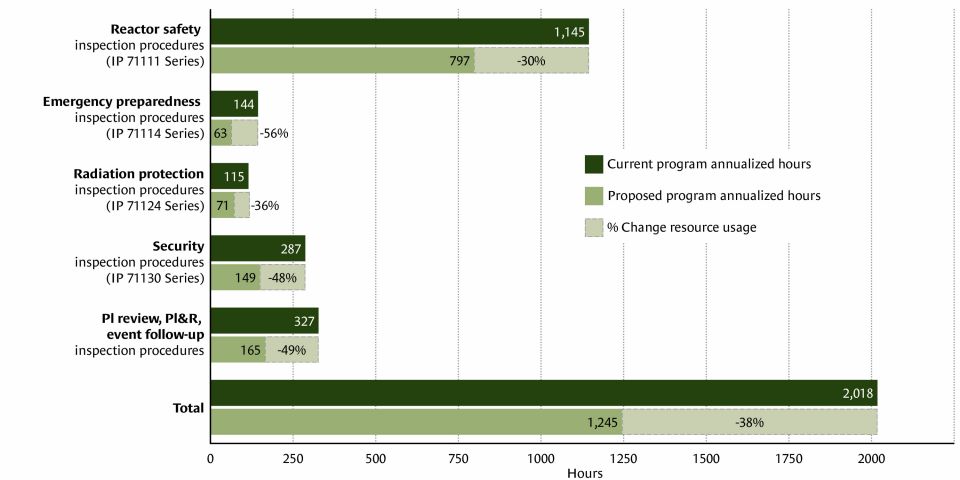

NRC staff proposes ROP, security inspection overhauls

The Nuclear Regulatory Commission staff is recommending proposed changes for the Reactor Oversight Process (ROP) baseline inspection program that could reduce the number of hours spent...

NRC ends work on three proposed rules for securing spent fuel

The Nuclear Regulatory Commission on Wednesday announced it was discontinuing three rulemaking activities intended to enhance the security of a deep geologic repository and the protection of...

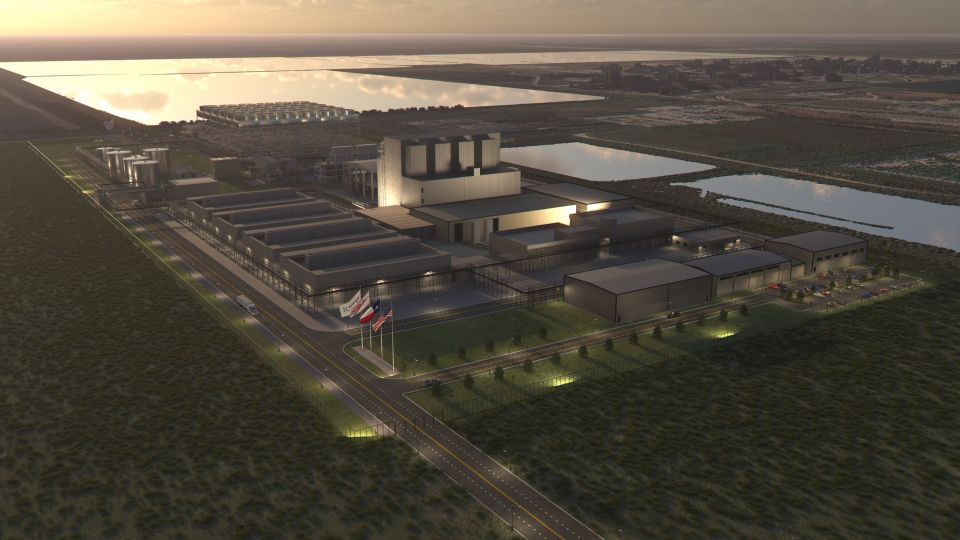

NRC board to hear challenges to Dow’s Long Mott application

A Nuclear Regulatory Commission Atomic Safety and Licensing Board (ASLB) will hear arguments on February 26 on challenges to a construction permit application from Long Mott Energy (LME) for a...

NRC posts hearing request notice for Belews Creek ESP application

An opportunity to request an adjudicatory hearing for Duke Energy Carolinas’ early site permit (ESP) application for the Belews Creek site in Stokes County, N.C., has been announced by the...

ANS hosts webinar on EPRI liquid fuel research

The American Nuclear Society’s Risk-informed, Performance-based Principles and Policy Committee (RP3C) has held another presentation in its monthly Community of Practice (CoP) series. Former...