U.S. uranium production up as companies press “go” on dormant operations

U.S. uranium production increased throughout 2024, with more growth planned in 2025. The producers who can make that happen, however, were burned before by a “renaissance” that didn’t take off. Now they are watching and waiting for signals from Washington, D.C., including the impacts of tariffs, shifting relationships with global uranium producers, and funding for the enrichment task orders designed to boost demand for U.S. uranium.

Uranium producers are keenly sensitive to price shifts. They build business plans that combine firm contracts with exposure to potential market gains and time investments in new capacity to meet scheduled deliveries. The production gains in late 2024 began months and even years earlier in response to renewed interest in nuclear energy and the Russian uranium ban, which was signed into law in May 2024. The Trump administration’s Energy Dominance Council identifies uranium as an “amazing energy asset,” and the administration’s actions on tariffs, funding, and the Russian uranium ban will determine how much of that “amazing” energy comes from U.S. sources.

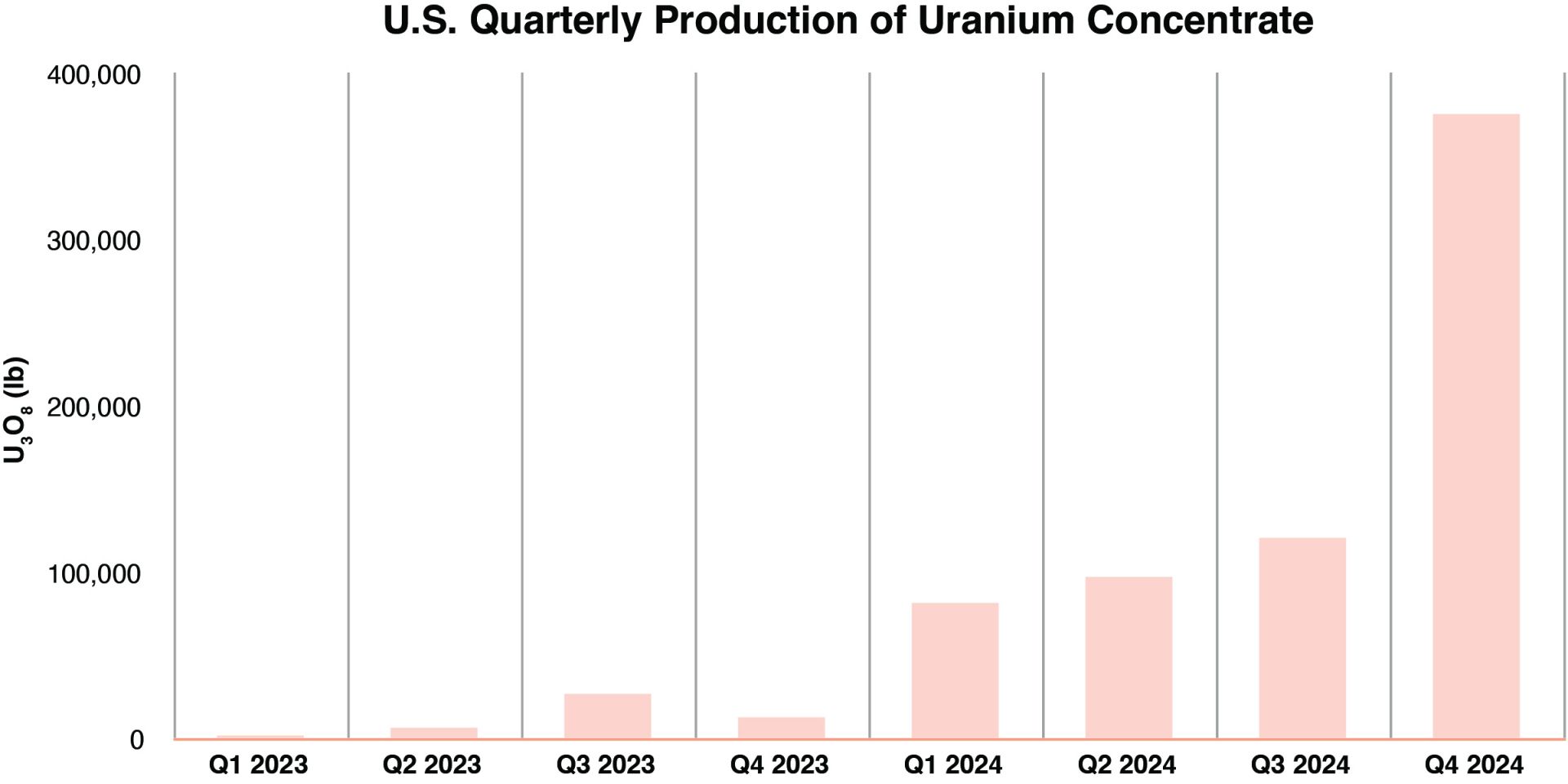

In front: In the fourth quarter of 2024, production of uranium concentrate at U.S. uranium processing facilities and mills reached 375,401 pounds U3O8, the highest quarterly uranium production since the third quarter of 2018, according to the latest U.S. Energy Information Administration data. Despite the gains, current U.S. production is dwarfed by the nation’s historical production—and by the nations currently producing most of the uranium used in the U.S. power reactor fleet, including Russia, Kazakhstan, Canada, and Australia.

In this article, NN’s customary coverage of enrichment technologies and new fuel developments is taking a backseat to the front of the front end of the nuclear fuel cycle—the production of uranium concentrate (U3O8) from in situ recovery (ISR) and processing and from conventional mining and milling. We’ll look at the companies behind the production growth in 2024 and their plans for 2025.

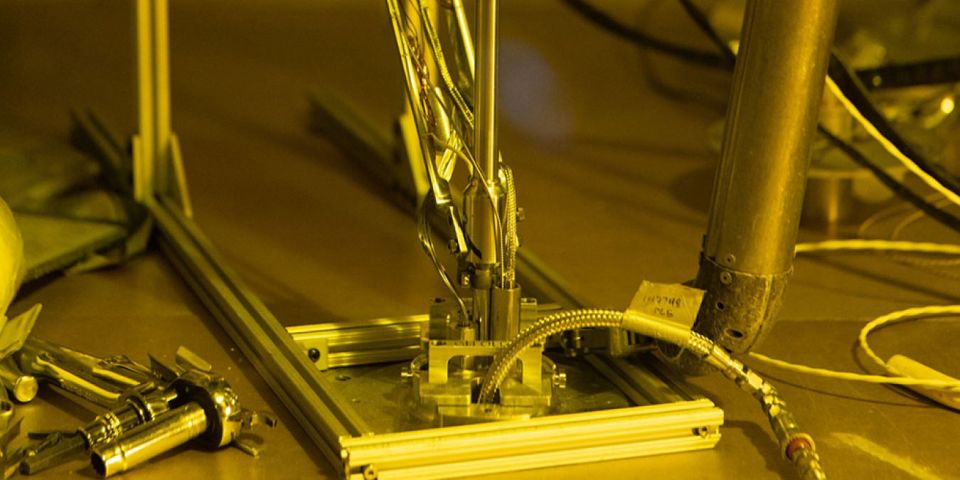

Energy Fuels’ White Mesa mill led U.S. uranium concentrate production for the fourth quarter of 2024. (Photo: Energy Fuels)

Energy Fuels: In February, Energy Fuels described 2024 as “a fundamental building year” marked by the restart of U.S. uranium mining. Energy Fuels owns the only operating conventional uranium mill in the United States—southern Utah’s White Mesa mill. During 2024, the company started mining at the Pinyon Plain mine in northern Arizona but kept that ore stockpiled during negotiations with the Navajo Nation about transporting the ore to White Mesa on highways that cross through Navajo land.

In January, Energy Fuels signed an agreement with the Navajo Nation for “the transport of uranium ore on the federal and state highways that traverse their land, subject to certain additional precautions and fees” and agreed to assist with the remediation of Cold War–era uranium mines left on Navajo land from government programs unrelated to Energy Fuels. Ore transport from Pinyon Plain to White Mesa resumed in February 2025.

As ore accumulated at Pinyon Plain during negotiations, Energy Fuels turned to “stockpiled alternate feed materials and newly mined ore” from its La Sal and Pandora mines, both in Utah, ultimately producing 157,525 pounds U3O8 during 2024. All production was attributed to the fourth quarter. Energy Fuels emerged as the top U.S. producer for the fourth quarter. For total 2024 production, Energy Fuels came in third, behind U-Energy and EnCore Energy.

Energy Fuels is preparing Nichols Ranch, an ISR project in Wyoming, for production “within one year of a ‘go’ decision, as market conditions warrant.”

EnCore Energy’s Alta Mesa in situ recovery uranium project accounted for the second-largest share of U.S. production in the fourth quarter of 2024. (Photo: EnCore Energy)

EnCore Energy: Coming in second—both for full-year and fourth-quarter production in 2024—is EnCore Energy’s Alta Mesa central processing plant in South Texas. The ISR processing plant accounted for the production of 127,293 pounds U3O8 production in the fourth quarter of 2024.

Energy Fuels anticipates more production in 2025, with a second ion exchange circuit recently installed at Alta Mesa to double the flow capacity. The company is also increasing the number of injection and extraction wells it has in operation.

Alta Mesa is a former producer—generating nearly 5 million pounds of uranium between 2005 and 2013, when production was curtailed because of low prices. Following the restart at Alta Mesa, EnCore anticipates future production that includes the Dewey-Burdock project in South Dakota (which EnCore acquired from Azarga Uranium in 2022) and the Gas Hills project in Wyoming.

EnCore Energy’s Rosita central processing plant is also operating in South Texas, having started production in 2023.

Ur-Energy: Ur-Energy reported February 10 that it was “the largest uranium producer in the U.S., according to the U.S. Energy Information Administration's Domestic Uranium Production Report Third Quarter 2024, released in December 2024.”

For the fourth quarter of 2024, Ur-Energy’s quarterly production of 74,006 pounds U3O8 was bested by quarterly totals from EnCore’s Alta Mesa project and Energy Fuels’ White Mesa mill, but Ur-Energy remained the top producer for 2024. The company’s leadership liked the policy signals of early February, stating, “Continued global support for nuclear energy and initial actions taken by the Trump administration in the U.S. indicate growing acceptance for nuclear energy.”

Ur-Energy’s Lost Creek ISR project in Wyoming was responsible for its 2024 production, with future production expected from the Shirley Basin ISR project (now under construction) in January 2026. By adding Shirley Basin, Ur-Energy expects to increase its licensed production capacity by about 83 percent.

Peninsula Energy: Peninsula Energy’s U.S. subsidiary, Strata Energy, restarted operations at its flagship Lance ISR project in December 2024 and expects to produce its first dry yellowcake by June 2025, once its processing plant is fully commissioned in the first half of the year. Peninsula says its Lance project is “one of the largest independent near-term uranium development projects in the U.S.,” and the state of Wyoming has approved an expansion of the authorized mine permit area.

The company’s Ross central processing plant (part of the larger Lance project) is credited with producing 2,669 pounds U3O8 during 2024.

UEC: In August 2024, ISR operations began at Uranium Energy Corporation’s Christensen Ranch project in Wyoming for the first time since 2018. On February 19, UEC announced that the Christensen Ranch output had been processed, dried, and drummed at the Irigaray processing plant. From Irigaray, the concentrate will head to the ConverDyn conversion facility in Metropolis, Ill.

UEC president and CEO Amir Adnani commented on the company’s outlook in February: “With energy security continuing as a national priority and the White House’s newly established National Energy Dominance Council recognizing uranium as an ‘amazing national asset,’ this milestone represents a meaningful step in fortifying America’s nuclear fuel supply chain. We expect the constrained availability of U.S.-origin uranium to drive premium pricing, creating a significant competitive advantage for UEC as the largest and fastest-growing uranium company in the country.”

UEC acquired Christensen Ranch, the Irigaray central processing plant, and other Wyoming uranium assets of Uranium One Americas from Uranium One (part of Russia’s Rosatom) in 2021. UEC grew again in December 2024 with the acquisition of Rio Tinto’s Sweetwater uranium mill and Wyoming uranium assets. The Sweetwater mill last operated in 1983 and has a licensed annual capacity of 4.1 million pounds U3O8. Now, UEC plans to “adapt the Sweetwater Plant to recover uranium from loaded resin produced by ISR operations.”

Cameco: Other uranium producers in the United States include Canadian company Cameco, which made a decision in 2016 to cease commercial production in 2018 at its Crow Butte and Smith Ranch-Highland facilities in the United States.

While Cameco is no longer developing new wellfields at Crow Butte (in Nebraska) and Smith Ranch-Highland (in Wyoming) and does not expect any production during 2025, the company is responsible for “care and maintenance” costs of between $14 million and $15 million for 2025 for its U.S. uranium properties.