Sufficient supply, uncertain demand influence uranium markets

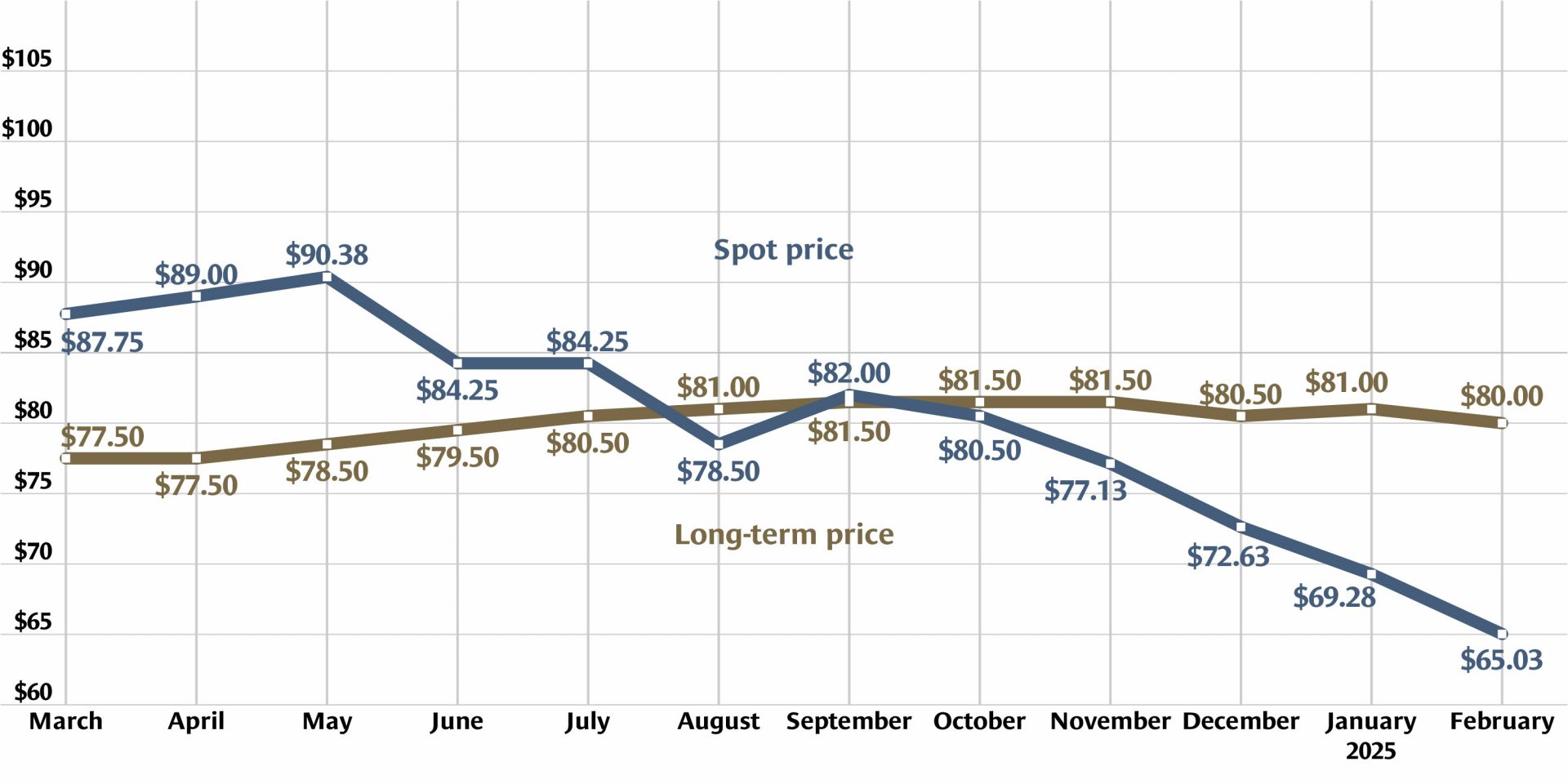

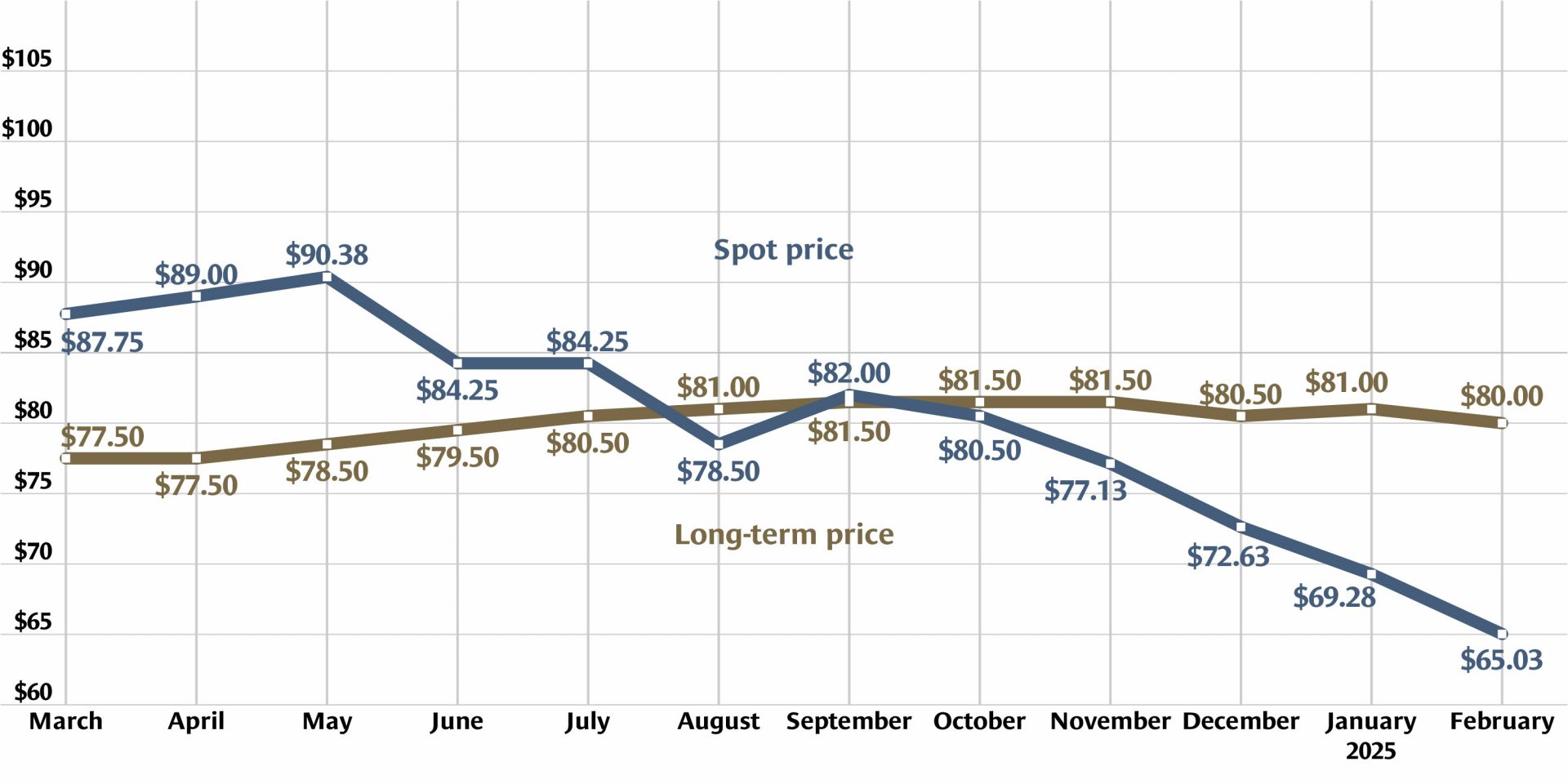

Uranium futures closed out February at about $65.55 per pound, according to online analysist firm Trading Economics. Futures prices have been below $66 per pound since mid-February.

A message from Goodway Technologies

Optimizing Maintenance Strategies in Power Generation: Embracing Predictive and Preventive Approaches

Uranium futures closed out February at about $65.55 per pound, according to online analysist firm Trading Economics. Futures prices have been below $66 per pound since mid-February.

Uncertainty contributes to lowest uranium spot prices in 18 months

A combination of plentiful supply and uncertain demand resulted in spot pricing for uranium closing out March below $64 per pound, with dips down to about $63.50 during mid-March—the lowest...

A good narrative for nuclear power

During an interview for Kitco News at the 2025 Prospectors & Developers Association of Canada (PDAC) Convention, held in Toronto in early March, the chief executive of British...

Trump suggests U.S. takeover of Zaporizhzhia plant in Ukraine-Russia ceasefire talks

Meanwhile, Russian-backed media report Ukraine is responsible for ZNPP strikes

Amid recent ceasefire talks between Russia and Ukraine, President Donald Trump suggested the U.S. should take control of Ukraine’s nuclear power plants for long-term security, the Associated...

Tennessee senators call on Trump to “rescue TVA from itself”

In a strongly worded opinion piece published by Power Magazine on March 24, Tennessee Sens. Marsha Blackburn and Bill Hagerty call for new leadership at the Tennessee Valley Authority to...

State legislation: Iowa governor pushing nuclear power

A pair of bills working their way through the Iowa statehouse aim to promote nuclear energy projects in the state—in part by changing how the plants would be regulated and funded....

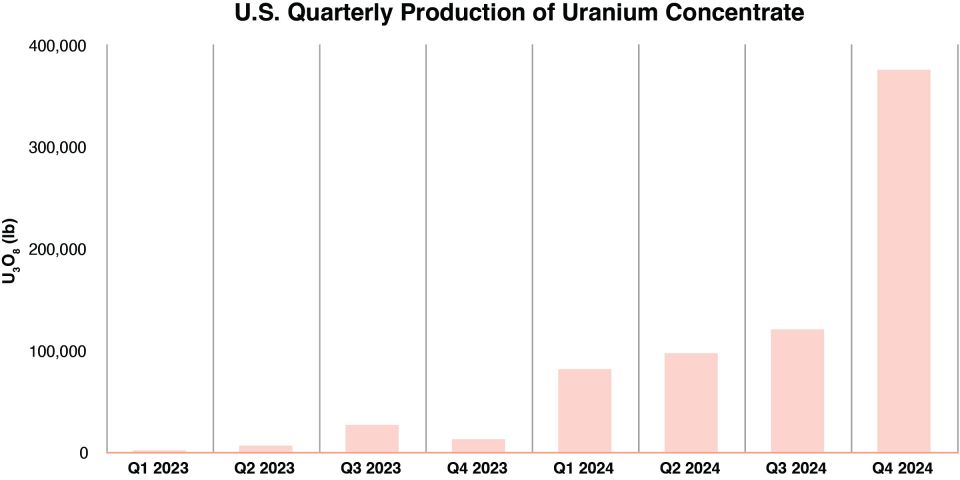

U.S. uranium production up as companies press “go” on dormant operations

U.S. uranium production increased throughout 2024, with more growth planned in 2025. The producers who can make that happen, however, were burned before by a “renaissance” that didn’t...

Fires extinguished at Chernobyl following drone strike

Ukraine’s State Emergency Service has finally gained full control over a blaze that started February 14 after a drone struck the protective dome over the destroyed reactor from the 1986...

TerraPower roundup: Progress for Natrium project

TerraPower has continued to make aggressive progress in several areas for its Natrium Reactor Demonstration Project since the beginning of the year. Natrium is an advanced 345-MWe reactor that...

Pronuclear leader wins German election

The conservative Christian Democratic Union came out on top in Germany’s February 23 election. CDU leader Friedrich Merz achieved a “lackluster win,” as the Associated Press termed it,...

Trump establishes National Energy Dominance Council

A new council within the president’s executive circle aims to advise Trump on strategies to “achieve energy dominance,” ultimately by boosting domestic energy production. ...