What about regulation? The flurry of activity this month comes after the states of Texas and Utah joined Last Energy to file a lawsuit against the Nuclear Regulatory Commission in the U.S. District Court in Texas in late December, claiming, in part, that the NRC, “despite its name, does not really regulate new nuclear reactor construction so much as ensure that it almost never happens.”

Just 38 days later, Last Energy submitted a regulatory engagement plan to the NRC. According to that plan, Last Energy intends to submit an early site permit by June 2025 under 10 CFR Part 52 “for at least one site currently under Last Energy’s control in Texas. The specific licensing pathway(s) that Last Energy chooses to take to ultimately construct and operate the project will depend on how various modernization efforts currently underway materialize. It is possible that these filings will occur prior to full completion of the early site permit.”

The NRC has been reviewing its regulatory framework and “identifying ways to streamline the licensing of microreactors, acknowledging their reduced risk profiles and enhanced safety features.”

A rendering of Natura’s MSR-100 reactor concept. (Image: Natura Resources)

Natura’s engagement with the NRC is less contentious, but still unusual, because Natura’s first work with the NRC was in the context of its support for a tiny, 1-MWt molten salt research reactor at Abilene Christian University. ACU now holds a construction permit for that research reactor, and Natura wants to follow with a commercial-scale 100-MWe liquid-fueled MSR.

Speaking on February 18 at the U.S. Nuclear Industry Council Advanced Reactor Summit, Natura Chief Executive Officer Doug Robison said the company plans to use the NRC’s Part 50 licensing process for its commercial reactor.

“We think that the high bar that the NRC represents in terms of safety . . . is something this nation should build off of,” Robison said, adding that preparing a quality license application that can stand up to the NRC’s review is “the developer’s responsibility.”

“We are supportive of the work the NRC is doing and we are looking forward to moving forward,” Robison said. “If we have the ability to mass construct reactors I think we’re going to see the NRC exhibit the ability to mass license those reactors.”

Natura’s plans for Texas: While the MSR-100 that Natura plans to build at TAMU’s RELLIS campus would provide electricity to the grid from what TAMU is calling an “Energy Proving Ground,” the company’s plans for West Texas are based on a newly announced memorandum of understanding with ACU and Texas Tech to collaborate with the Texas Produced Water Consortium (located at Texas Tech) to combine MSR technology with water desalination systems.

At a Permian Basin site, Natura plans to provide electricity to oil and gas operations, plus heat for water desalination systems. The water that would be treated is so-called “produced water”: natural groundwater that comes to the surface along with oil and natural gas during fracking operations. Often considered a waste stream from those operations, the water must be treated before it can be released for agriculture or other uses. Natura believes that heat from a co-located reactor could help address that challenge in the Permian Basin and provide a source of water to arid West Texas.

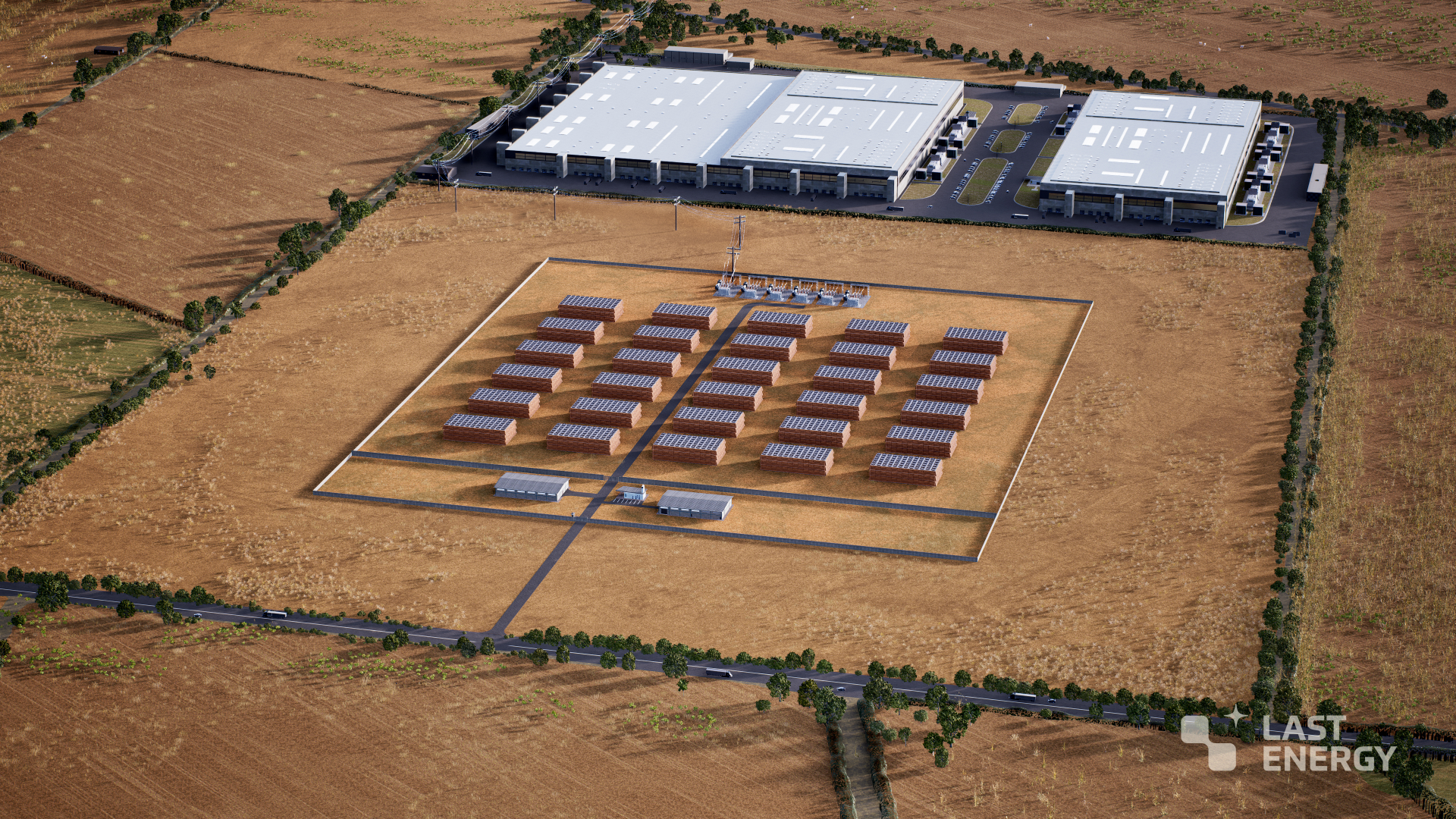

More on Last Energy in Texas . . . This morning, Last Energy announced it holds a site in Haskell County, Texas, about 200 miles west of Dallas, and has applied for an Electric Reliability Council of Texas (ERCOT) grid connection for 30 20-MWe pressurized water reactors to serve data centers. The company also reports it has secured its first full-core load of conventional PWR fuel, scheduled to arrive in September 2026.

Data centers make up Last Energy’s largest customer segment, the company said, citing agreements for another 39 microreactors in Europe and anticipated demand growth in Texas, which already has more than 340 data centers. Last Energy says it would provide power to offtakers both through private wires and grid transmission.

. . . and in the U.K.: In October 2024, Last Energy announced plans to deploy four microreactors in South Wales at a vacant site that once housed coal-fired power plants. Earlier this month, the company announced that it had become “the first SMR developer to be admitted into U.K. site licensing” effective January 1, following early engagement that began in May 2024.

That news followed closely on planned U.K. regulatory reforms announced February 6 in a press release that declared: “Government rips up rules to fire-up nuclear power . . . Prime Minister slashes red tape to get Britain building.” The new rules will permit building smaller reactors and building “anywhere across England and Wales,” and a preexisting list of just eight allowed nuclear sites has been discarded.

.png)