Russia restrictions: The uranium market continued to be affected in January by Ukraine war–related restrictions on imports from Russia, which has long been a major supplier of global uranium enrichment capacity. Both the United States and Europe reduced their uranium purchases from Russia in 2024, while Russia imposed “temporary” restrictions on the export of enriched uranium to the West. These actions “shrunk the pool of yellowcake consumers in the market for mined uranium,” Trading Economics said.

Nevertheless, the availability of yellowcake has remained “relatively ample,” according to the firm, and this availability is expected to continue as U.S. import wavers for nuclear fuel are scheduled to expire by 2027.

DeepSeek: Other factors currently affecting the market are “speculative positions on nuclear power demand” for data centers in the United States “following the emergence of more efficient large language models.” Trading Economics said that China claims that its open-source DeepSeek artificial intelligence technology consumes “95% less power than established U.S. counterparts, erasing the race to develop alternative power sources. Such deals included nuclear power plants coming on line to service data centers for Microsoft, Alphabet, and Amazon Web Services.”

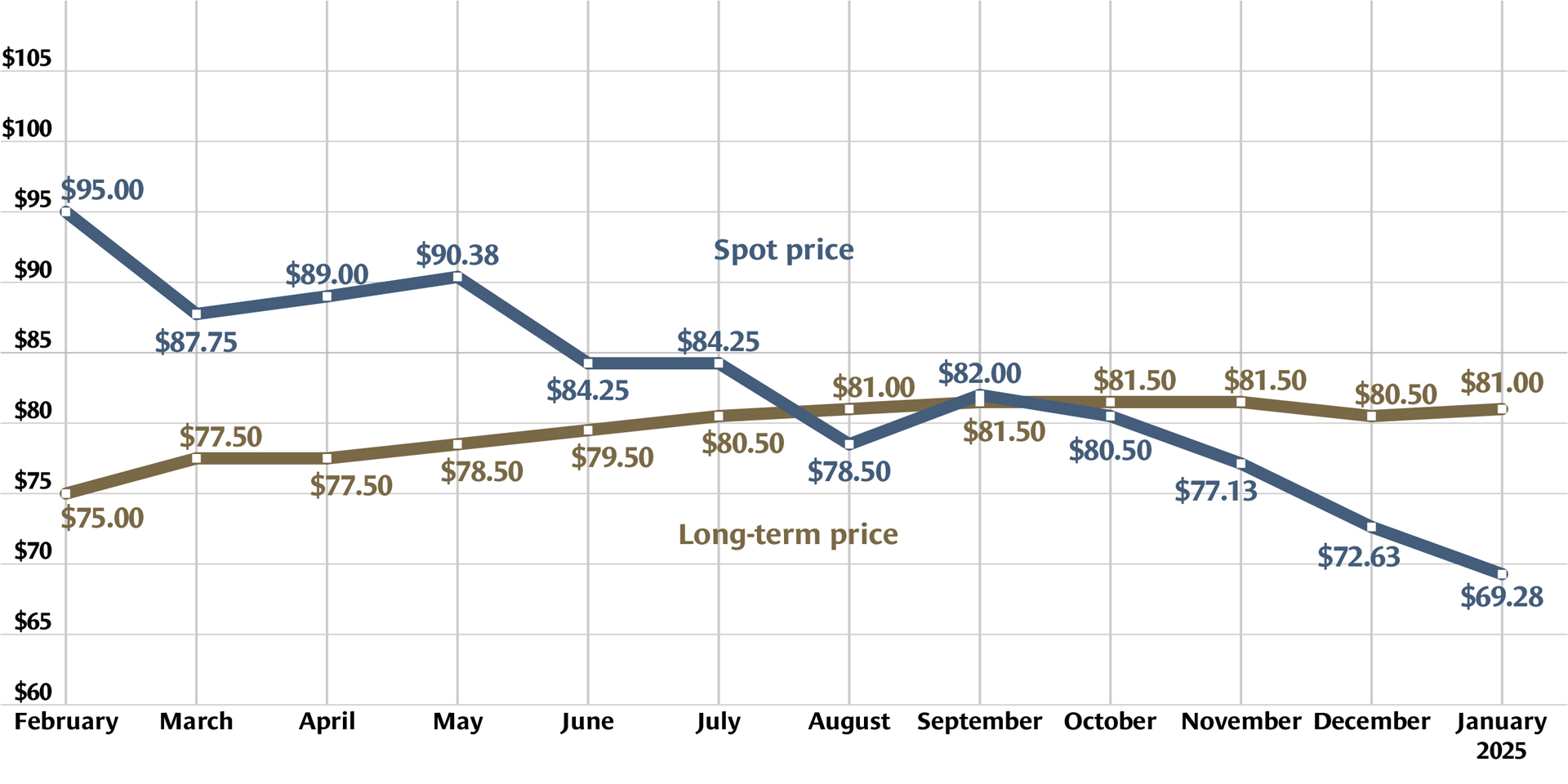

CNN reported that the news about DeepSeek “sent shockwaves through markets, in particular the tech sector” on January 27—the same day that uranium futures fell below $69/lb .

Forecast: Trading Economics expects uranium to trade at $72.18/lb by the end of the first quarter of 2025. Within 12 months, uranium is predicted to be trading at $74.75/lb.